Fraud Detection from Statistical Analysis and ML to Actionable Insights

Overview:

In my approach to catching credit card fraud, I see it as a problem of sorting into two groups. But since the data we have is heavily skewed, it’s tough to draw a line that separates fraudulent and legit transactions. To deal with this, I follow a step-by-step plan. First, I look at how data variables tied to both fraudulent and legit transactions spread out to get a better understanding of the data. Then, I use a simple stats model, like logistic regression, to get a feel for how different variables affect fraud. After that, I upgrade the model to a more flexible one, using techniques to choose the best features and decrease the size of the majority class to boost the model’s ability to predict fraud. I also demonstrate how boosting models, like Lightgbm, can help improve the model’s performance. Plus, I use Shapley values to explain what the model predicts, giving useful insights for the business. At the end of it all, we have a chat about the findings and what they mean in practice.

Here is a breakdown of the steps included in this notebook:

- Exploration of Data

- Statistical Analysis

- Logistic Regression

- Recursive Feature Elimination

- Downsizing the Majority Class

- Complex Model

- Explainable AI

- Final Remarks, Discussion, and Practical Insights

import pandas as pd

import seaborn as sns

import lightgbm as lgb

import shap

import random

import matplotlib.pyplot as plt

import statsmodels.api as sm

from sklearn.model_selection import train_test_split

from sklearn.linear_model import LogisticRegression

from yellowbrick.model_selection import learning_curve

from yellowbrick.model_selection import FeatureImportances

from yellowbrick.classifier import *

from sklearn.decomposition import PCA

from imblearn.under_sampling import RandomUnderSampler

from lightgbm import LGBMClassifier

from sklearn.calibration import CalibratedClassifierCV

from sklearn.preprocessing import StandardScaler

from sklearn.feature_selection import RFE

import warnings

warnings.filterwarnings('ignore')

Reusable Helper Functions:

def get_dataframe_from_summary(est):

results_summary = est.summary()

results_as_html = results_summary.tables[1].as_html()

return pd.read_html(results_as_html, header=0, index_col=0)[0]

def get_regressor_coefficients(model, columns):

coefficients = {}

for coefficient, feature in zip(model.coef_, columns):

coefficients[feature] = coefficient

return coefficients

def ge_learning_curve(model, x, y, cv, scoring='f1'):

learning_curve(model, x, y, cv=cv, scoring=scoring)

def get_FeatureImportances(model, X, y):

viz = FeatureImportances(model)

viz.fit(X, y)

viz.show()

def get_ROCAUC(model, x_train, y_train, x_test, y_test, classes):

visualizer = ROCAUC(model, classes=classes)

visualizer.fit(x_train, y_train)

visualizer.score(x_test, y_test)

visualizer.show()

def get_PrecisionRecallCurve(model, x_train, y_train, x_test, y_test):

viz = PrecisionRecallCurve(model)

viz.fit(x_train, y_train)

viz.score(x_test, y_test)

viz.show()

def get_ConfusionMatrix(model, x_train, y_train, x_test, y_test):

cm = ConfusionMatrix(model, classes=["non_fraud", "fraud"])

cm.fit(x_train, y_train)

cm.score(x_test, y_test)

cm.show()

def get_DiscriminationThreshold(model, X, y):

visualizer = DiscriminationThreshold(model)

visualizer.fit(X, y)

visualizer.show()

def feature_importance_plot(importances, feature_labels, ax=None):

importa = pd.DataFrame({"Importance": importances,

"Feature": feature_labels})

importa.sort_values("Importance", inplace=True, ascending=False)

fig, axis = (None, ax) if ax else plt.subplots(nrows=1, ncols=1, figsize=(5, 10))

sns.barplot(x="Importance", y="Feature", ax=axis, data=importa)

axis.set_title('Feature Importance Measures')

plt.close()

return axis if ax else fig

Exploration of Data

data = pd.read_csv("data/creditcard.csv")

data.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 284807 entries, 0 to 284806

Data columns (total 31 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Time 284807 non-null float64

1 V1 284807 non-null float64

2 V2 284807 non-null float64

3 V3 284807 non-null float64

4 V4 284807 non-null float64

5 V5 284807 non-null float64

6 V6 284807 non-null float64

7 V7 284807 non-null float64

8 V8 284807 non-null float64

9 V9 284807 non-null float64

10 V10 284807 non-null float64

11 V11 284807 non-null float64

12 V12 284807 non-null float64

13 V13 284807 non-null float64

14 V14 284807 non-null float64

15 V15 284807 non-null float64

16 V16 284807 non-null float64

17 V17 284807 non-null float64

18 V18 284807 non-null float64

19 V19 284807 non-null float64

20 V20 284807 non-null float64

21 V21 284807 non-null float64

22 V22 284807 non-null float64

23 V23 284807 non-null float64

24 V24 284807 non-null float64

25 V25 284807 non-null float64

26 V26 284807 non-null float64

27 V27 284807 non-null float64

28 V28 284807 non-null float64

29 Amount 284807 non-null float64

30 Class 284807 non-null int64

dtypes: float64(30), int64(1)

memory usage: 67.4 MB

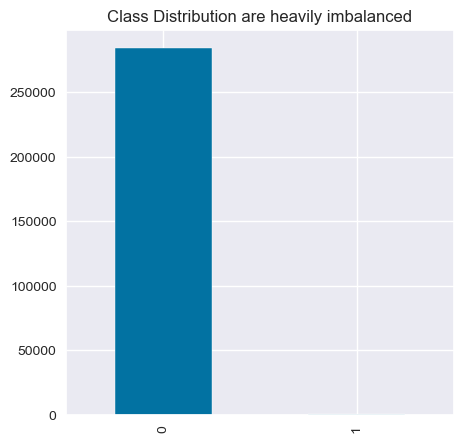

plt.figure(figsize=(5, 5))

data["Class"].value_counts().plot(kind="bar",title="Class Distribution are heavily imbalanced")

<Axes: title={'center': 'Class Distribution are heavily imbalanced'}>

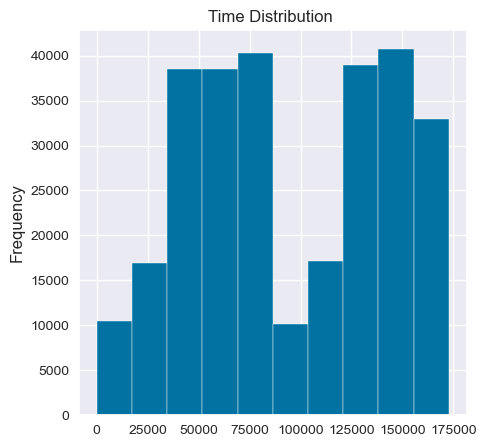

plt.figure(figsize=(5, 5))

data["Time"].plot(kind="hist",title="Time Distribution ")

<Axes: title={'center': 'Time Distribution '}, ylabel='Frequency'>

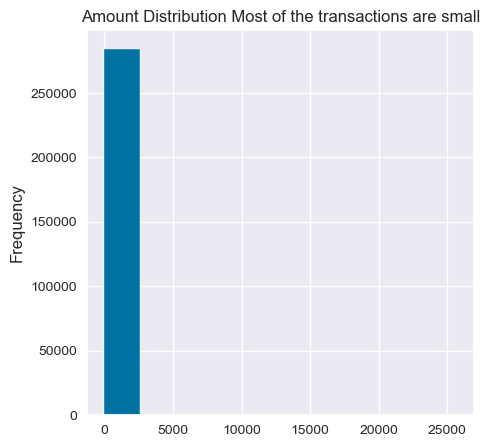

plt.figure(figsize=(5, 5))

data["Amount"].plot(kind="hist",title="Amount Distribution Most of the transactions are small")

<Axes: title={'center': 'Amount Distribution Most of the transactions are small'}, ylabel='Frequency'>

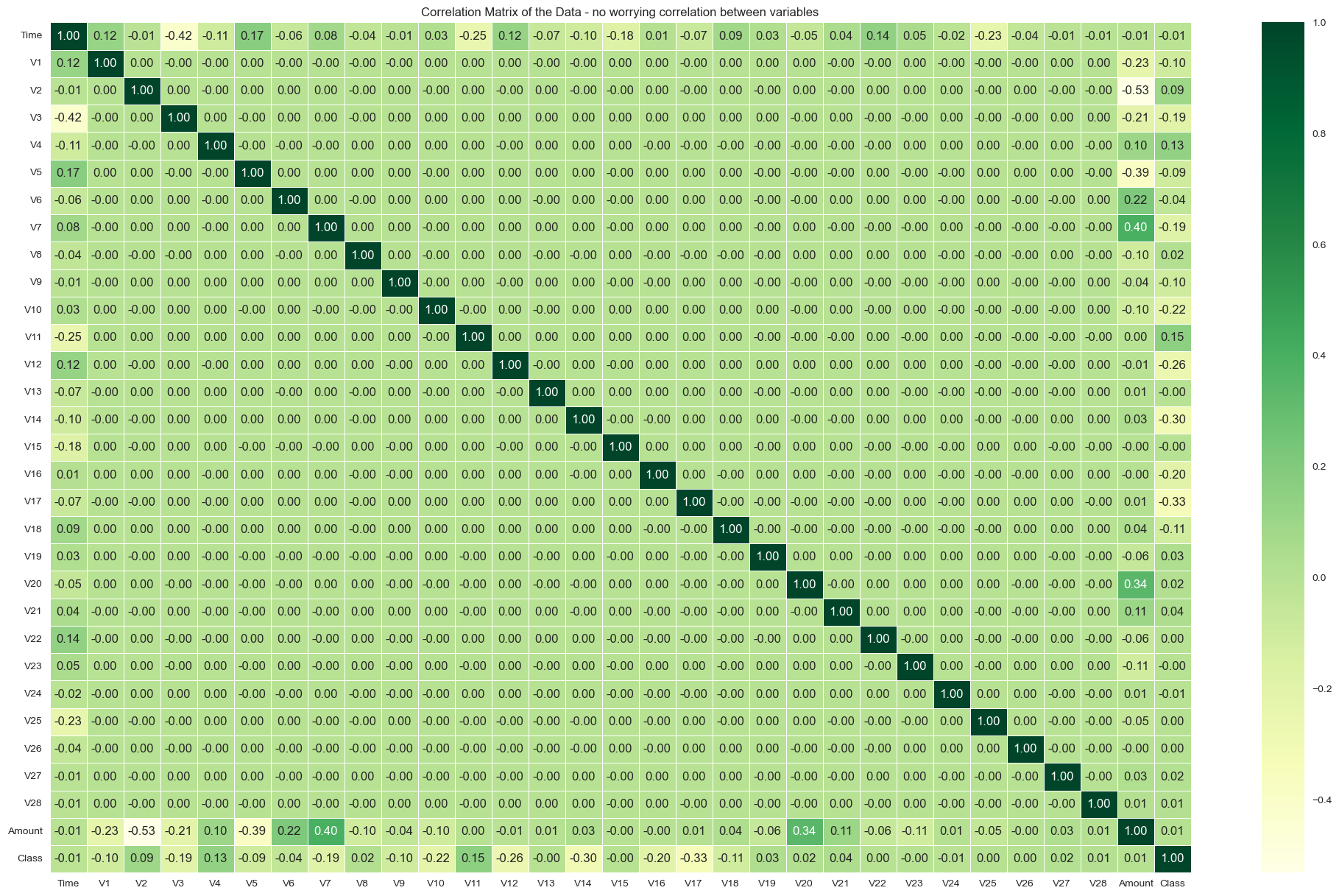

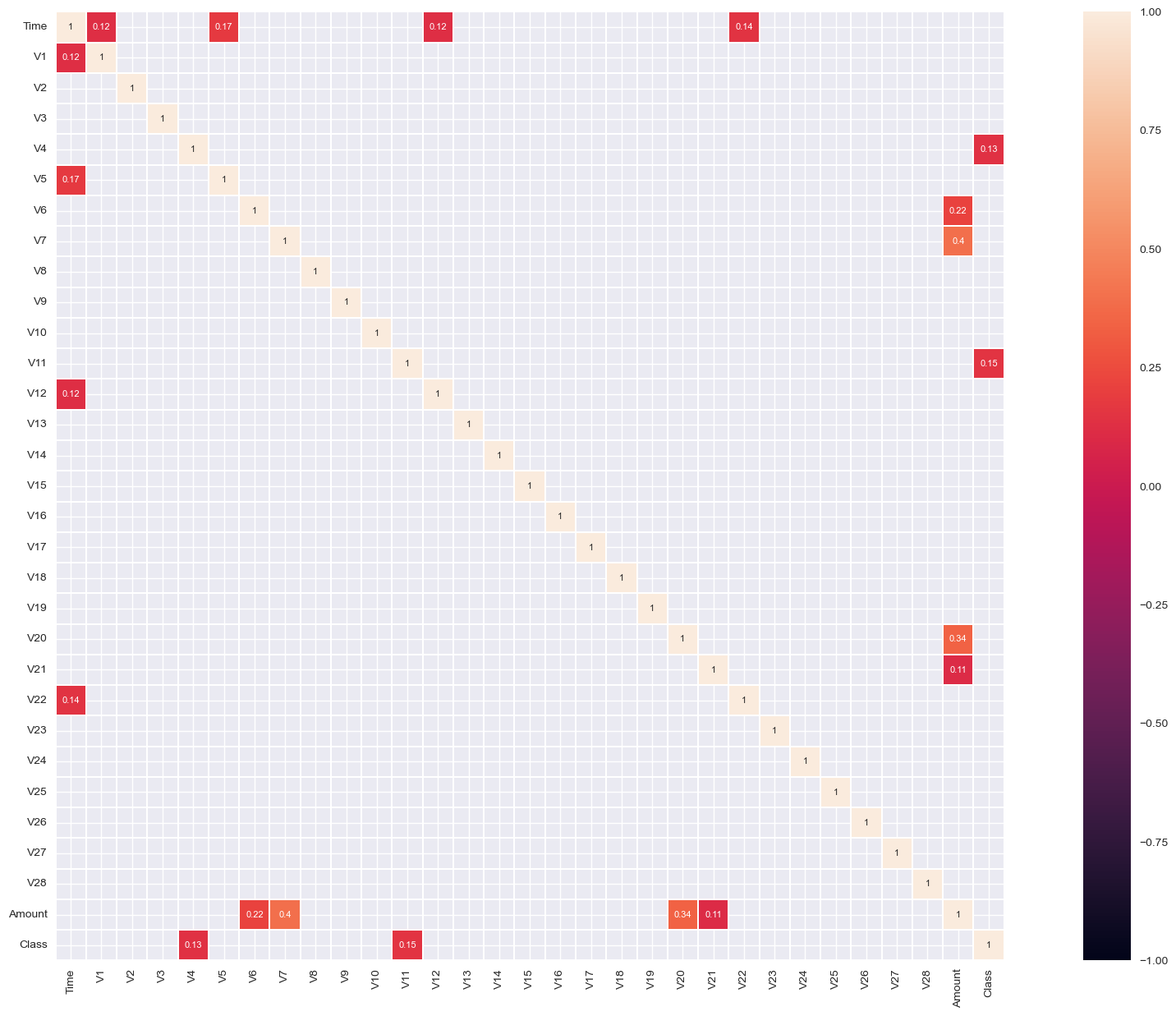

correlations:

corr= data.corr()

plt.figure(figsize=(25, 15))

sns.heatmap(corr, cmap="YlGn", annot=True, fmt=".2f", linewidths=0.5, cbar=True).set(title="Correlation Matrix of the Data - no worrying correlation between variables")

plt.show()

corr = data.corr()

plt.figure(figsize=(25, 15))

sns.heatmap(corr[(corr >= 0.1)], vmax=1.0, vmin=-1.0, linewidths=0.1, annot=True, annot_kws={"size": 8}, square=True);

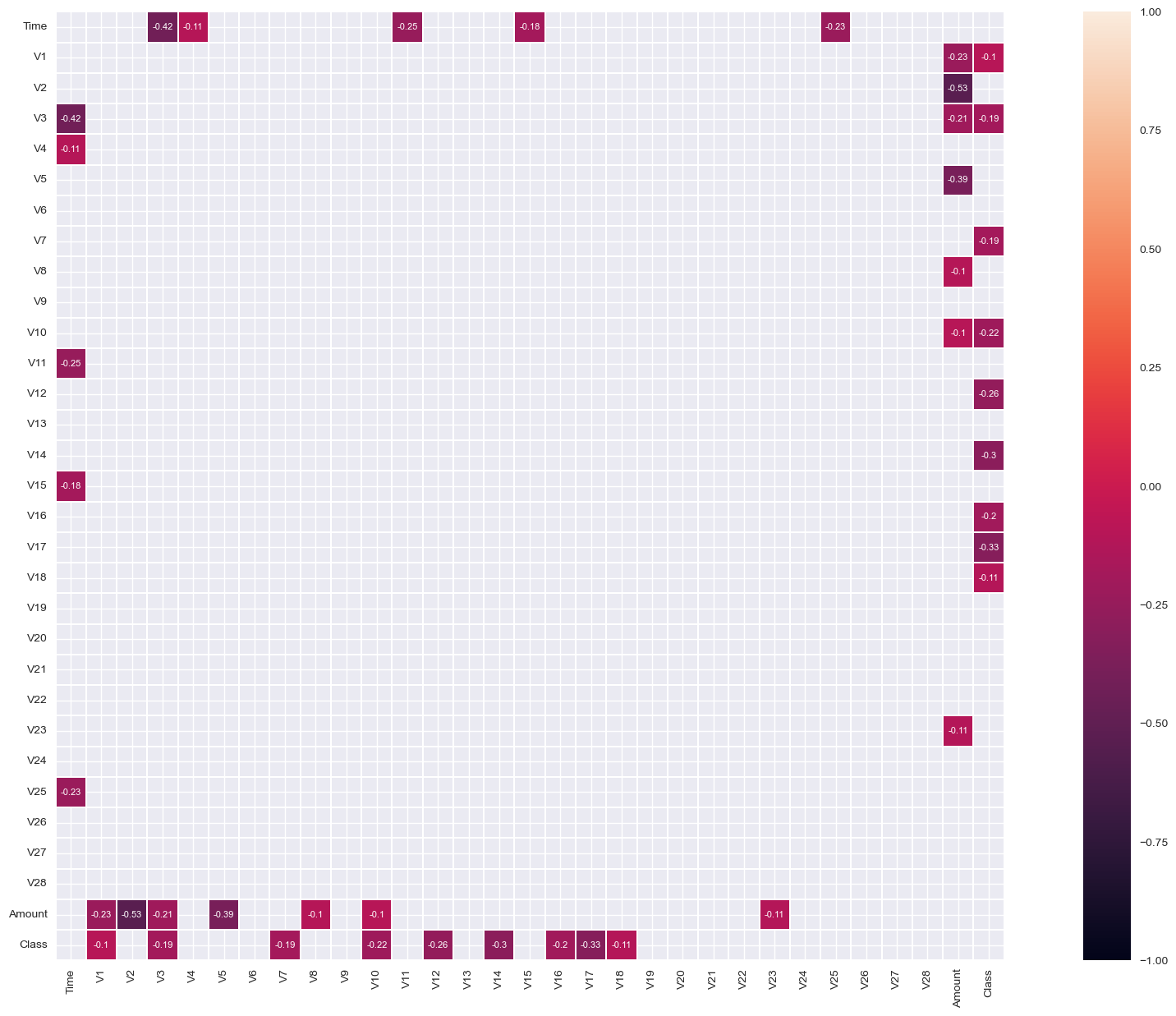

corr = data.corr()

plt.figure(figsize=(25, 15))

sns.heatmap(corr[(corr <= -0.1)], vmax=1.0, vmin=-1.0, linewidths=0.1, annot=True, annot_kws={"size": 8}, square=True);

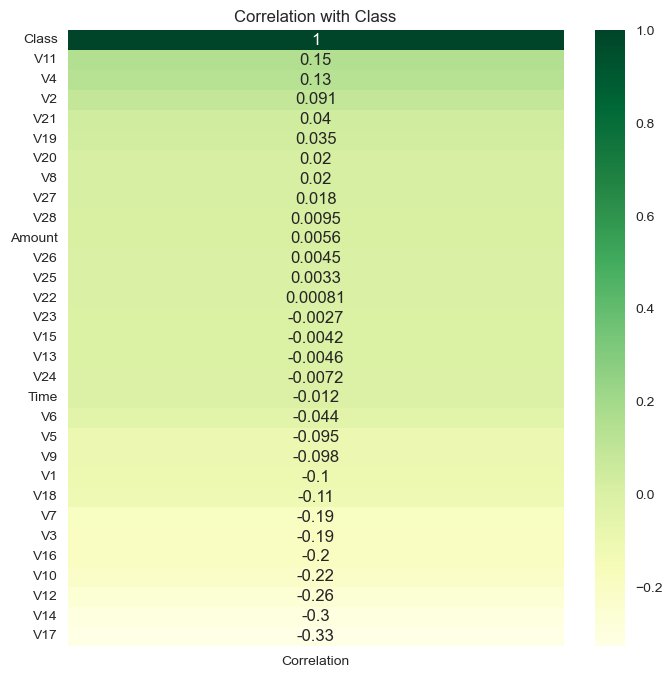

Correlation with target variable:

corr_with_target = data.corrwith(data['Class'])

corr_df = pd.DataFrame(corr_with_target, columns=['Correlation'])

corr_df.dropna(inplace=True)

corr_df.sort_values(inplace=True,by="Correlation",ascending=False)

plt.figure(figsize=(8, 8))

sns.heatmap(corr_df, cmap="YlGn", annot=True).set(title="Correlation with Class")

plt.show()

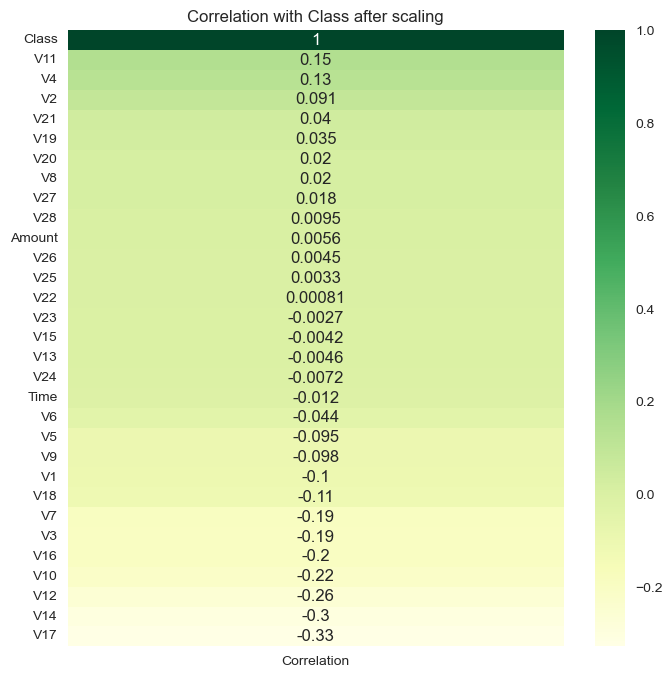

let’s see if scaling amount and time variables has any effect on the correlation:

col_to_scale = ["Time","Amount"]

scaler = StandardScaler()

copied_data = data.copy()

copied_data[col_to_scale] = scaler.fit_transform(copied_data[col_to_scale])

corr_with_target = copied_data.corrwith(data['Class'])

corr_df = pd.DataFrame(corr_with_target, columns=['Correlation'])

corr_df.dropna(inplace=True)

corr_df.sort_values(inplace=True,by="Correlation",ascending=False)

plt.figure(figsize=(8, 8))

sns.heatmap(corr_df, cmap="YlGn", annot=True).set(title="Correlation with Class after scaling")

[Text(0.5, 1.0, 'Correlation with Class after scaling')]

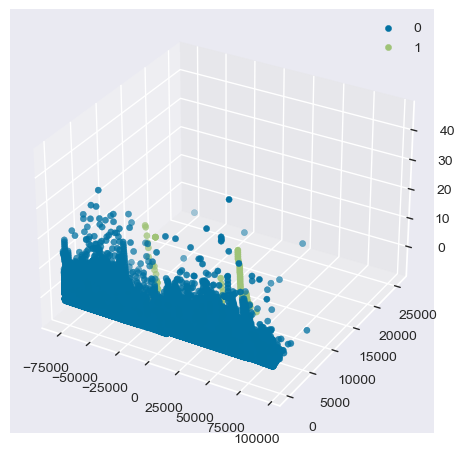

Dimensionality Reduction and Visualization of the data variables with respect to the target variable:

X = data.drop(columns='Class')

pca = PCA(n_components=3)

components = pca.fit_transform(X)

components = pd.DataFrame(components, columns=['PC1', 'PC2', 'PC3'])

components["Class"] = data["Class"]

fig = plt.figure()

ax = fig.add_subplot(111, projection='3d')

for s in components.Class.unique():

ax.scatter(components.PC1[components.Class==s],

components.PC2[components.Class==s],

components.PC3[components.Class==s],

label=s)

ax.legend()

<matplotlib.legend.Legend at 0x16c74e020>

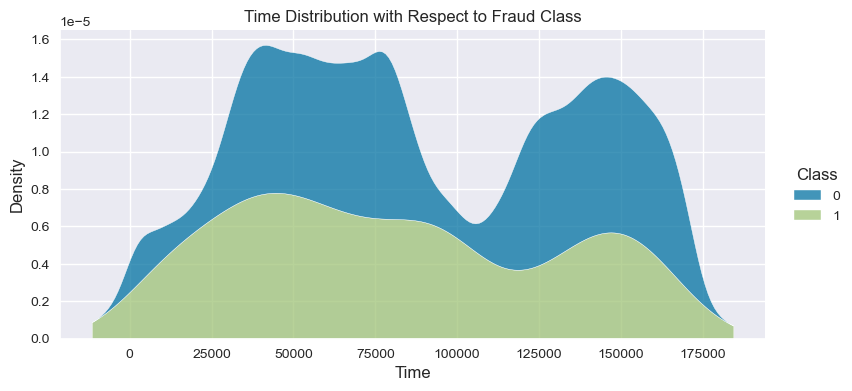

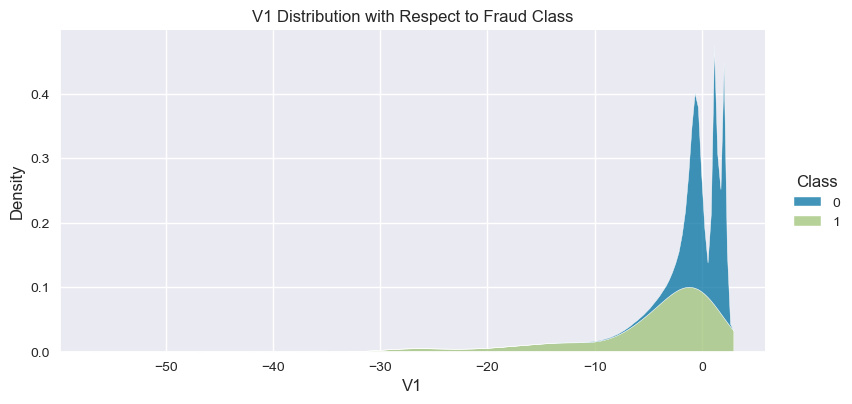

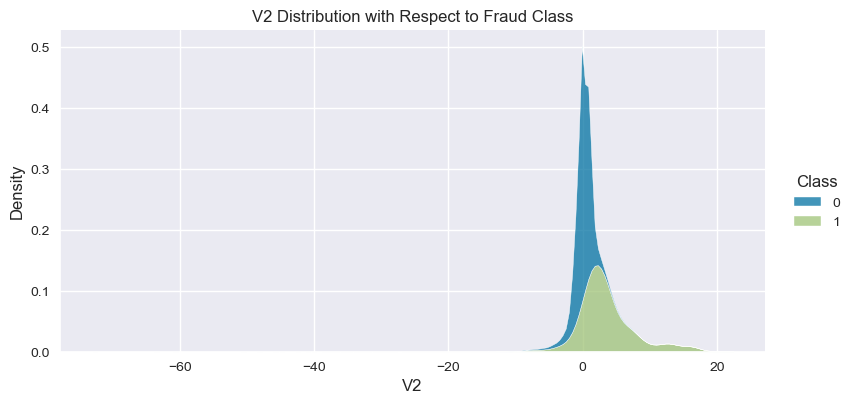

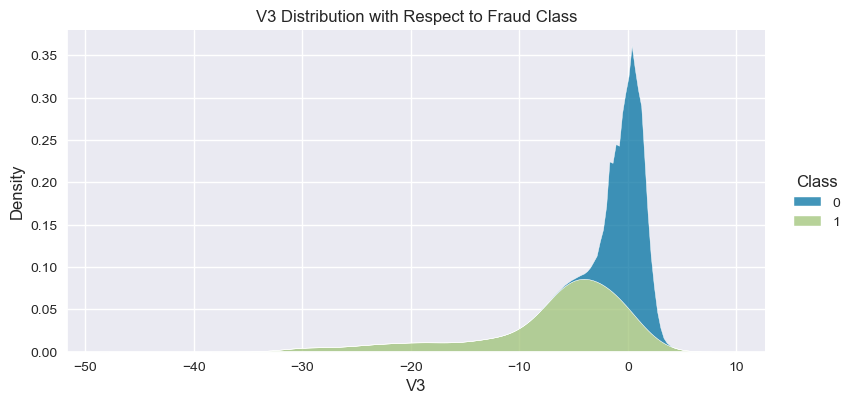

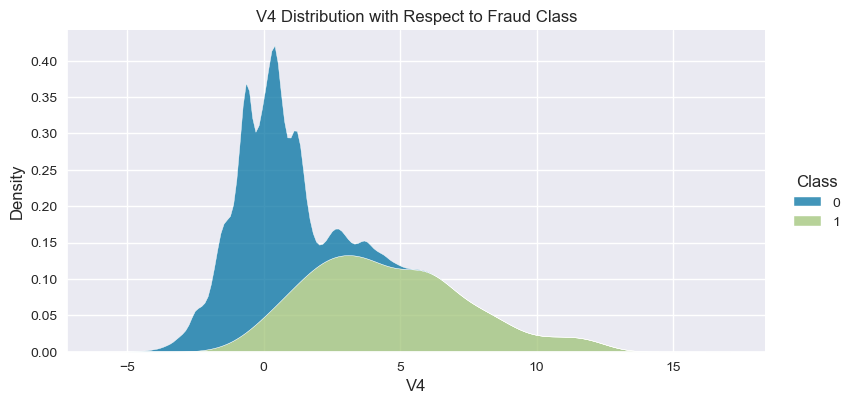

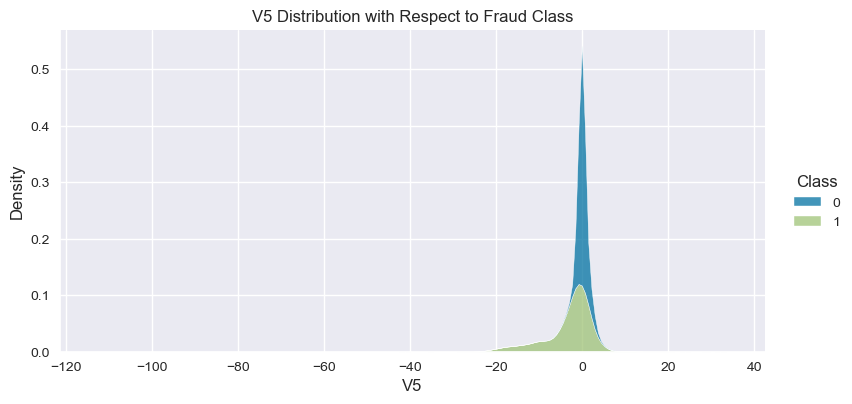

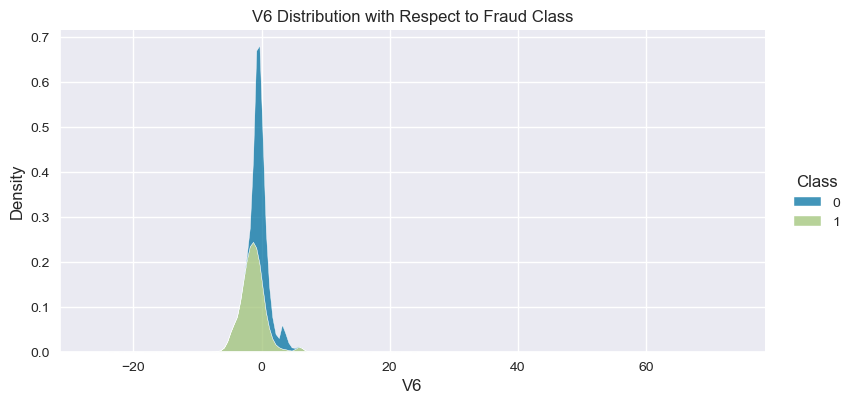

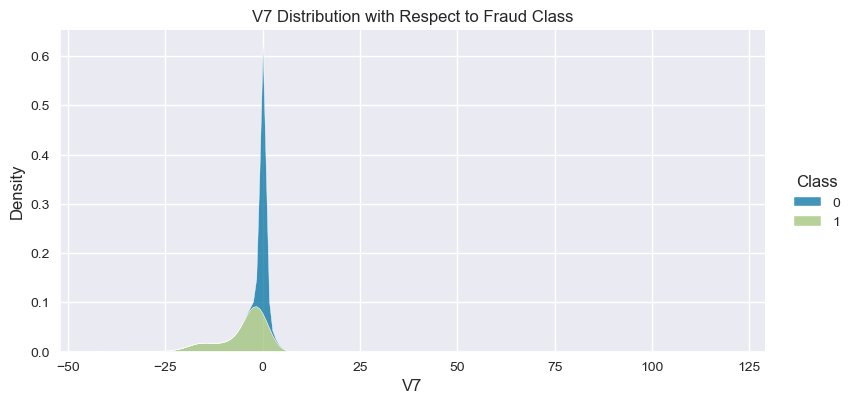

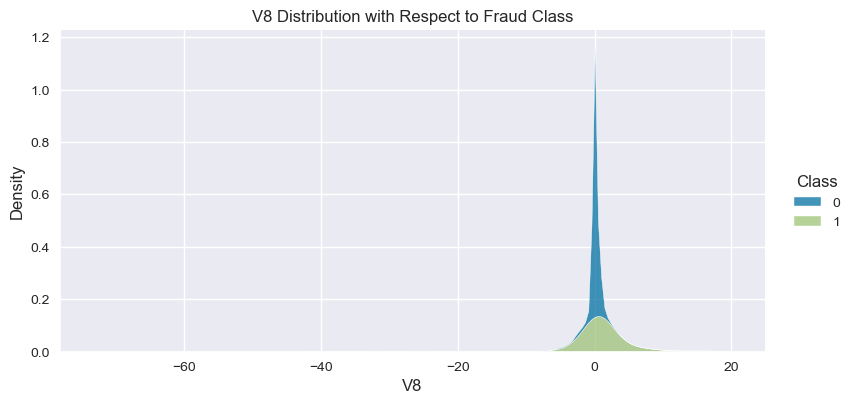

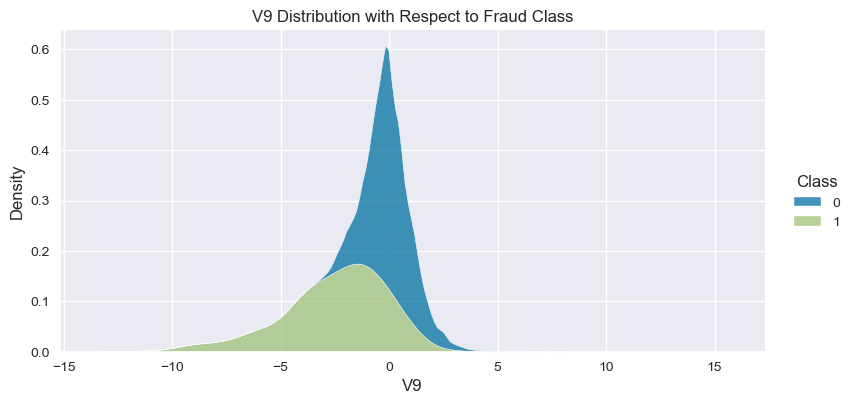

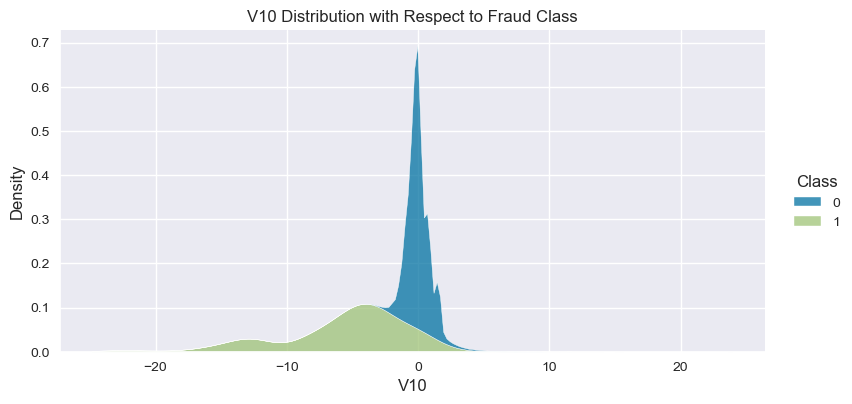

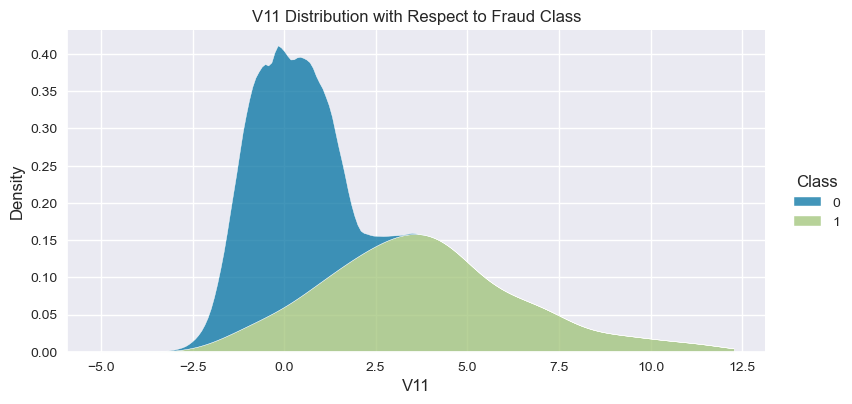

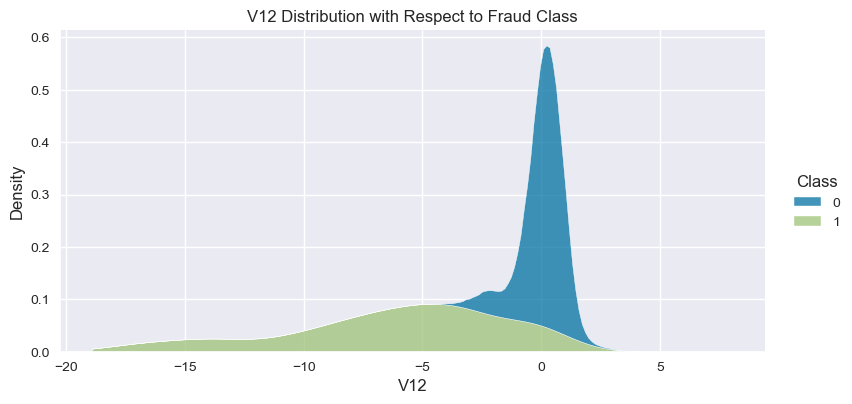

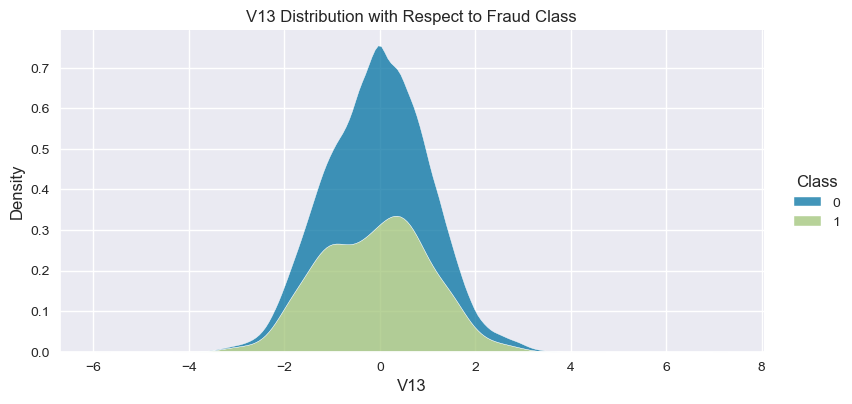

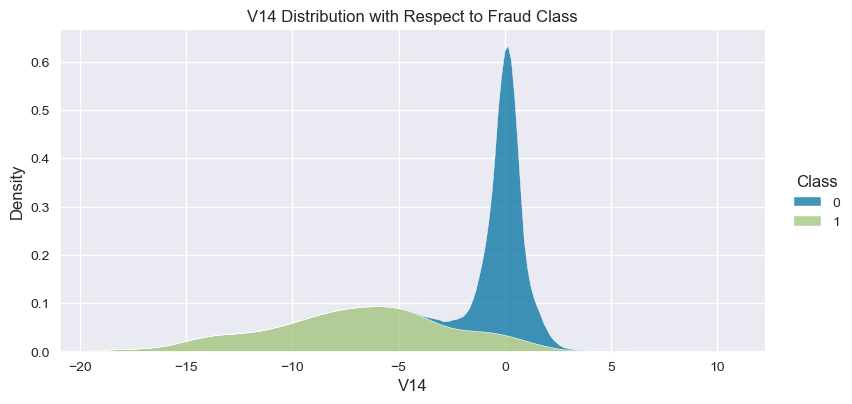

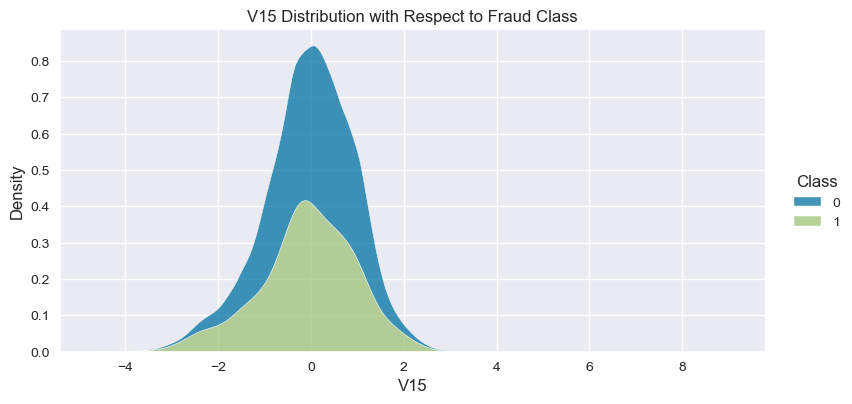

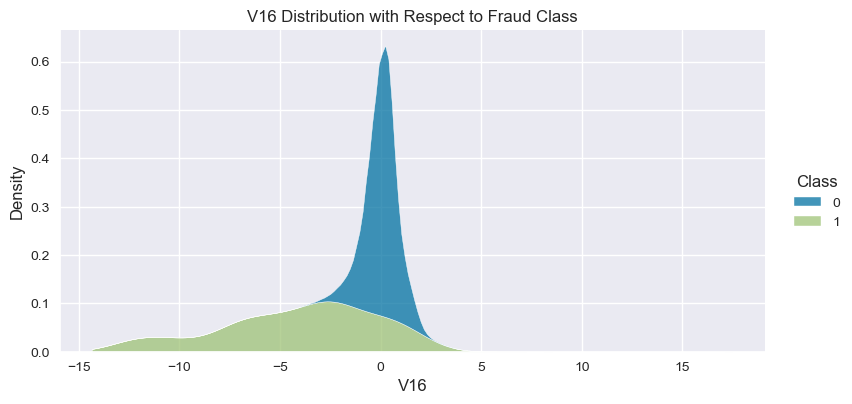

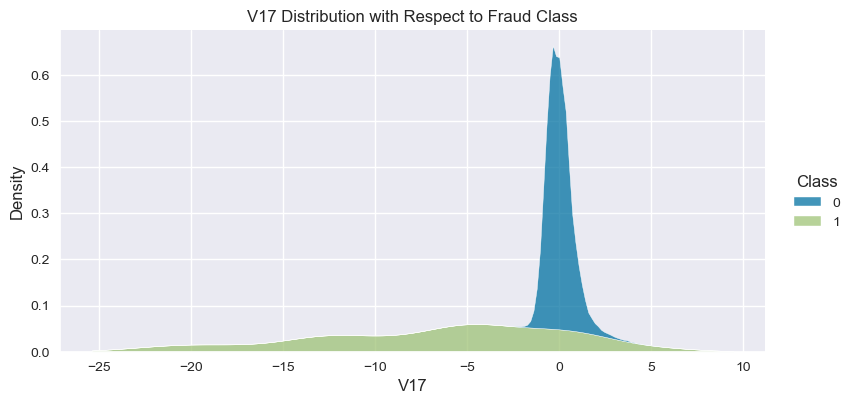

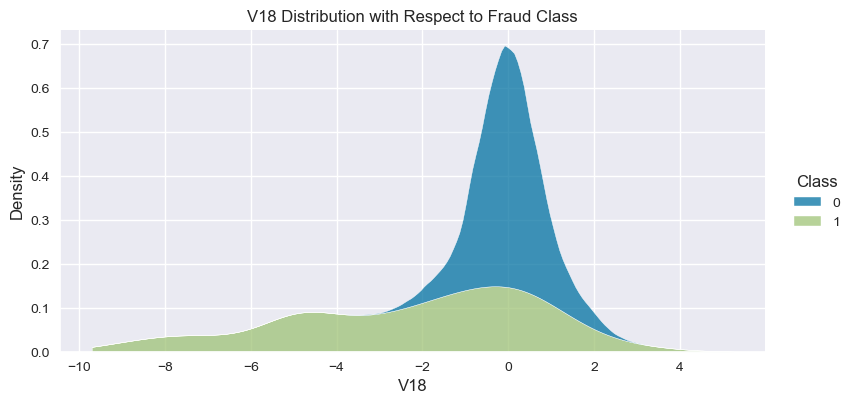

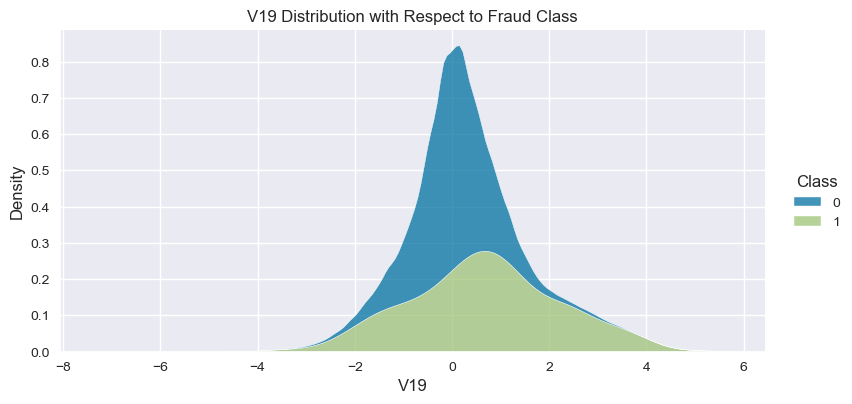

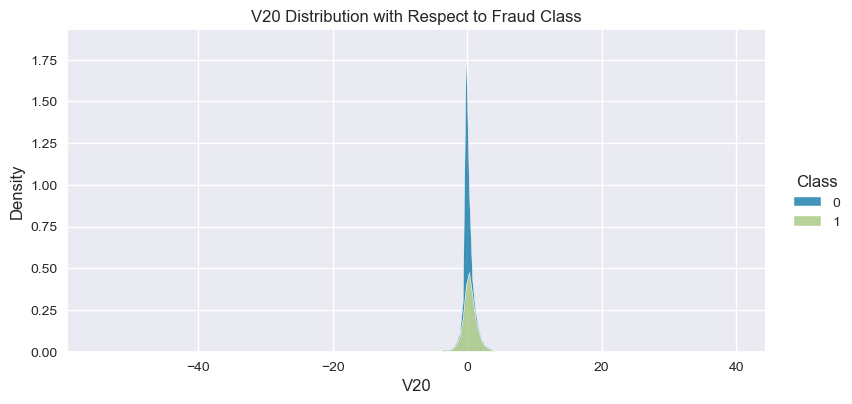

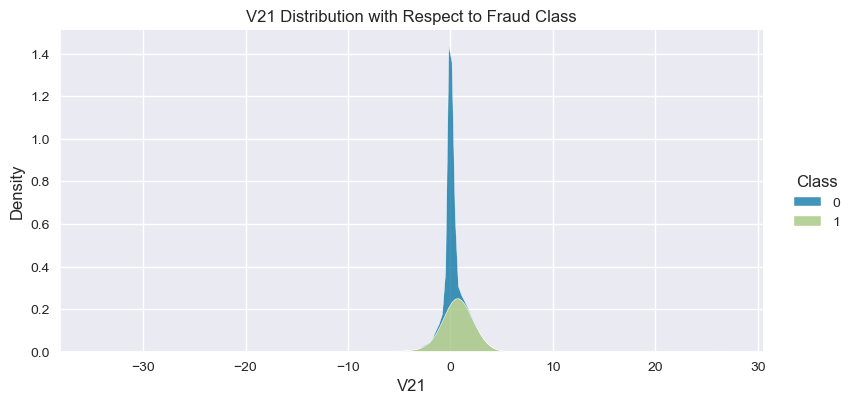

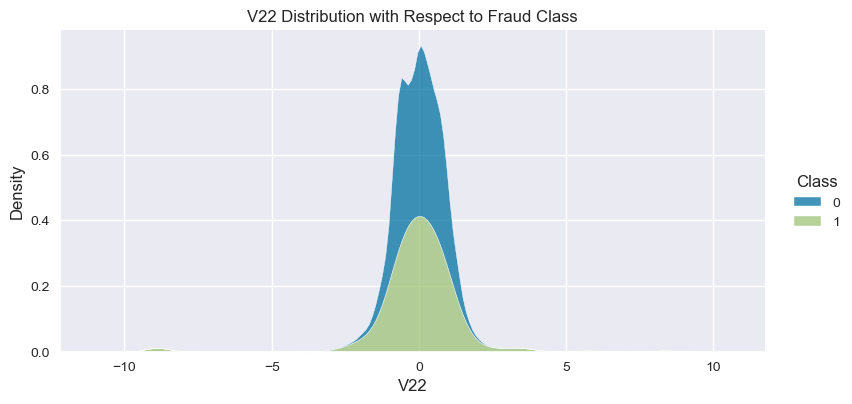

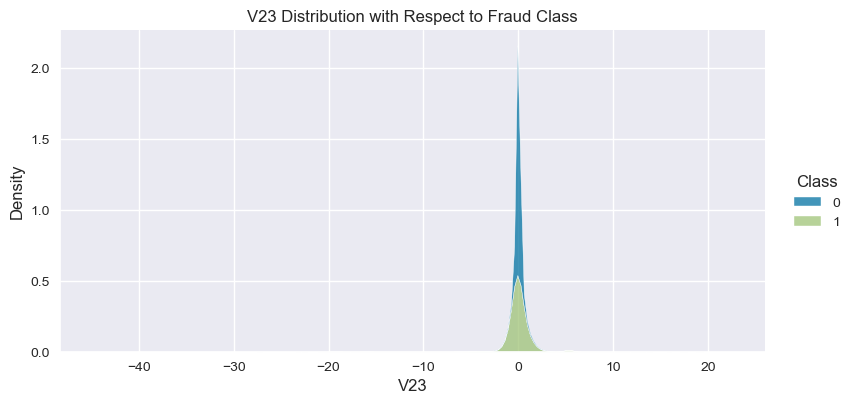

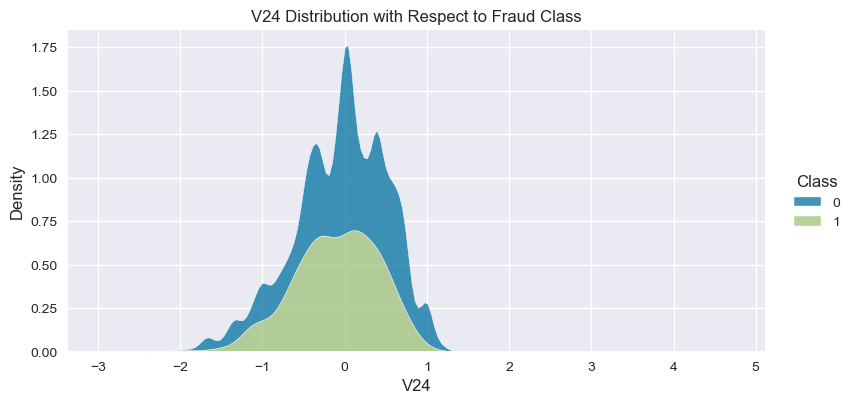

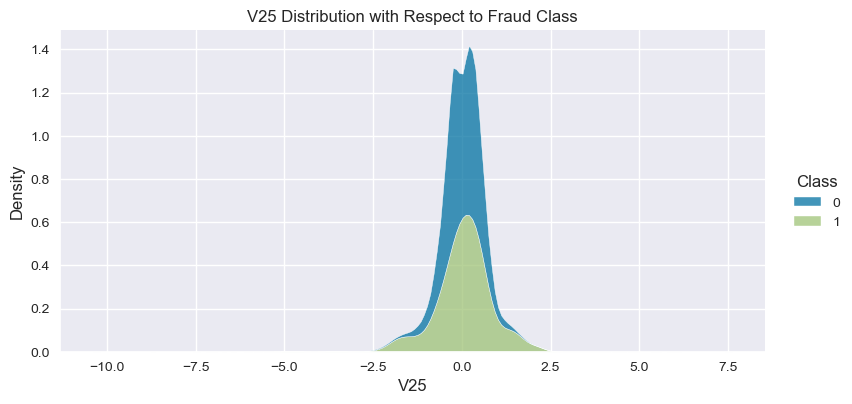

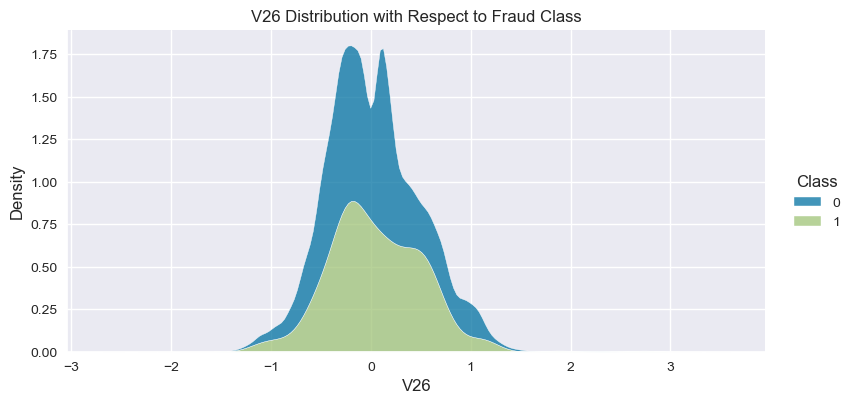

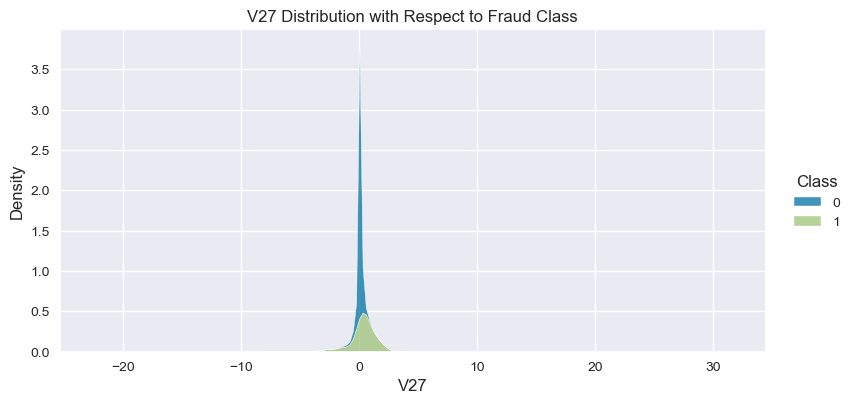

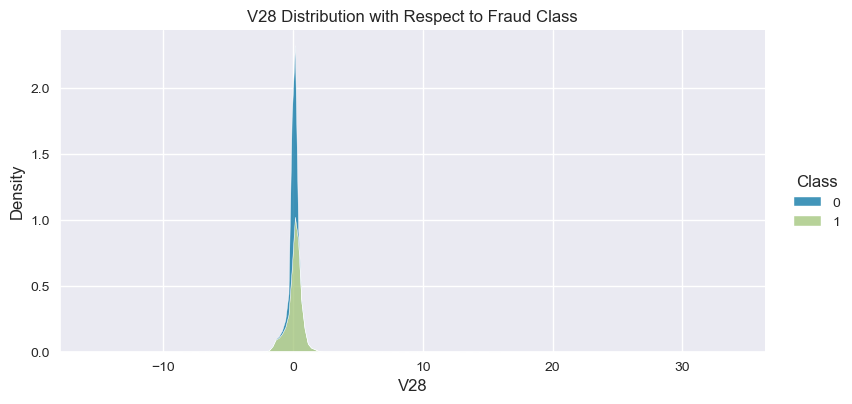

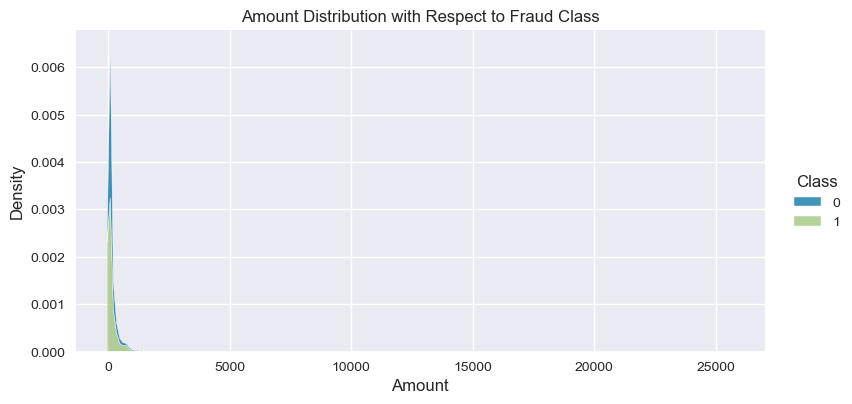

Understand the data from numerical columns distributions and target variable distribution:

numeric_data_col = data._get_numeric_data().columns

for col in numeric_data_col:

if col != "Class":

sns.displot(data,

x=col,

hue="Class",

# stat="density",

common_norm=False,

multiple="stack",

height=4,

aspect=2,

kind="kde",

).set(title=col+" Distribution with Respect to Fraud Class")

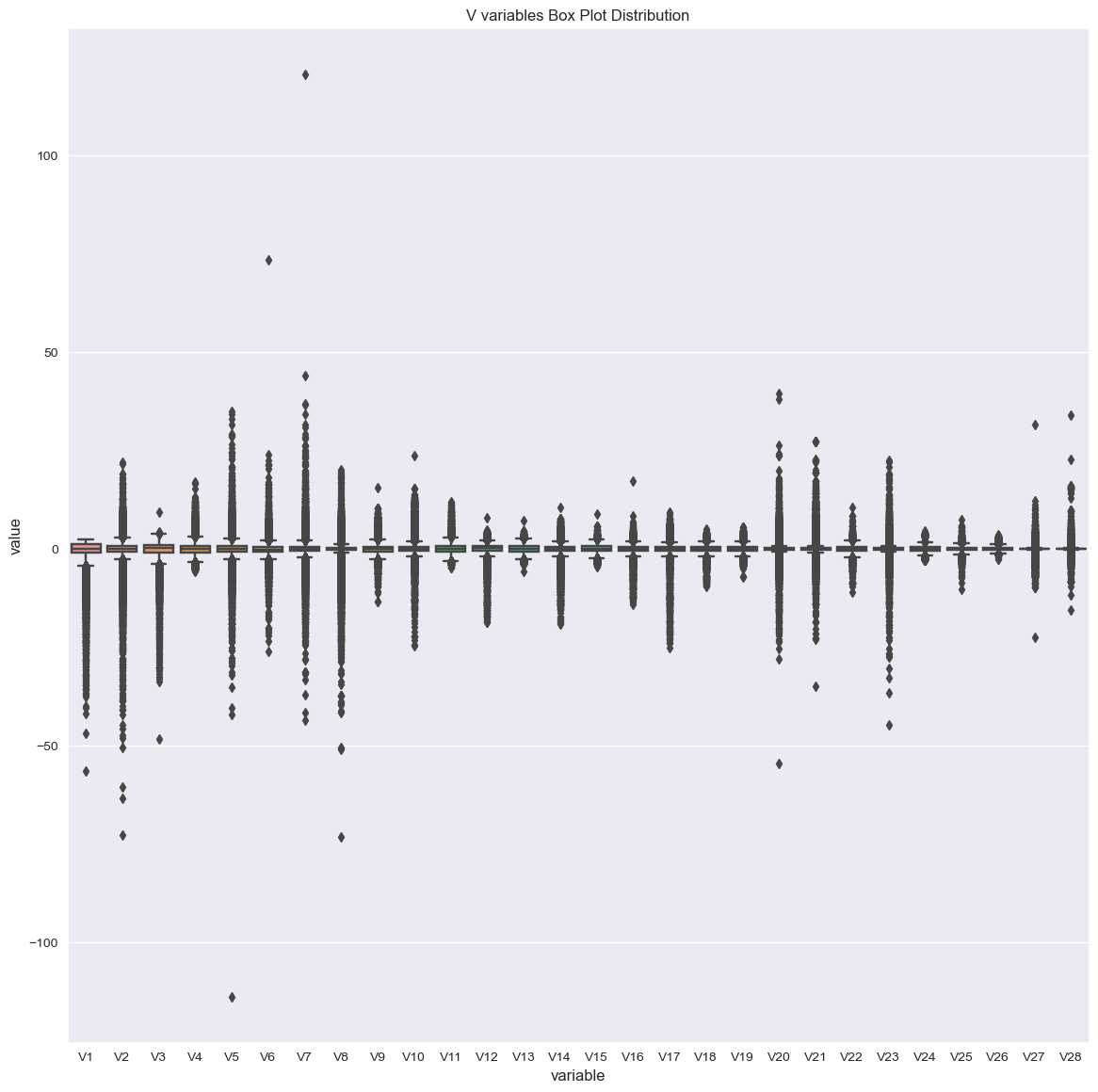

plt.figure(figsize=(14, 14))

vs = [col for col in data.columns if col.startswith("V")]

sns.boxplot(x="variable", y="value", data=pd.melt(data[vs])).set(title="V variables Box Plot Distribution")

plt.show()

# generate id column to keep track of the rows:

data["ID"] = range(1, len(data) + 1)

# check if ID is unique:

data["ID"].is_unique

True

Hard to detect outliers by inspecting the data, let’s use IQR to detect outliers:

# we aim to calculate the IQR for each column in the DataFrame for the majority class:

# Define the threshold for outliers

threshold = 1.5

non_fraud = data[data["Class"] ==0]

independent_variables = data.drop(["Class","ID"],axis=1).columns

overall_outliers = []

# # Iterate over each column in the DataFrame

for col in independent_variables:

# Calculate the IQR for the current column

Q1 = non_fraud[col].quantile(0.25)

Q3 = non_fraud[col].quantile(0.75)

IQR = Q3 - Q1

# Calculate the lower and upper bounds for outliers

lower_bound = Q1 - threshold * IQR

upper_bound = Q3 + threshold * IQR

# Find the outliers in the current column

outliers = non_fraud[(non_fraud[col] < lower_bound) | (non_fraud[col] > upper_bound)]["ID"]

# Append the outliers to the overall list

overall_outliers.extend(outliers.tolist())

#non fraud outliers:

len(set(overall_outliers))

138361

# copy the data to keep track of the original data:

outliers_removed = data.copy()

# drop the outliers:

outliers_removed = outliers_removed[~outliers_removed["ID"].isin(set(overall_outliers))]

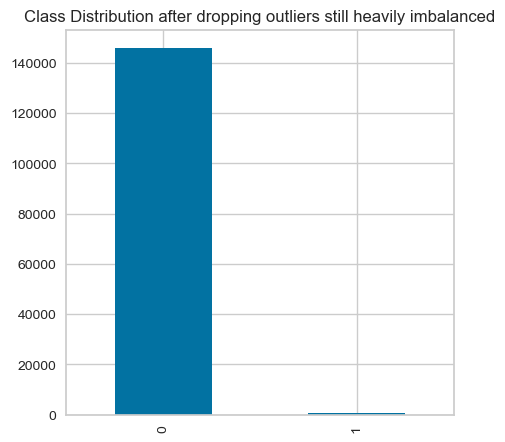

Check the class distribution after dropping outliers:

plt.figure(figsize=(5, 5))

outliers_removed["Class"].value_counts().plot(kind="bar",title="Class Distribution after dropping outliers still heavily imbalanced")

<AxesSubplot: title={'center': 'Class Distribution after dropping outliers still heavily imbalanced'}>

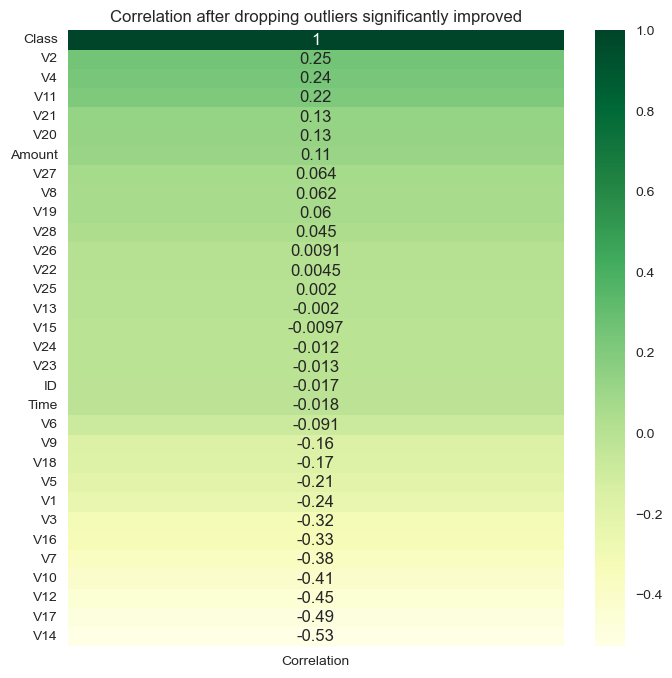

Show correlation after dropping outliers:

corr_with_target = data.corrwith(outliers_removed['Class'])

corr_df = pd.DataFrame(corr_with_target, columns=['Correlation'])

corr_df.dropna(inplace=True)

corr_df.sort_values(inplace=True,by="Correlation",ascending=False)

plt.figure(figsize=(8, 8))

sns.heatmap(corr_df, cmap="YlGn", annot=True).set(title="Correlation after dropping outliers significantly improved")

plt.show()

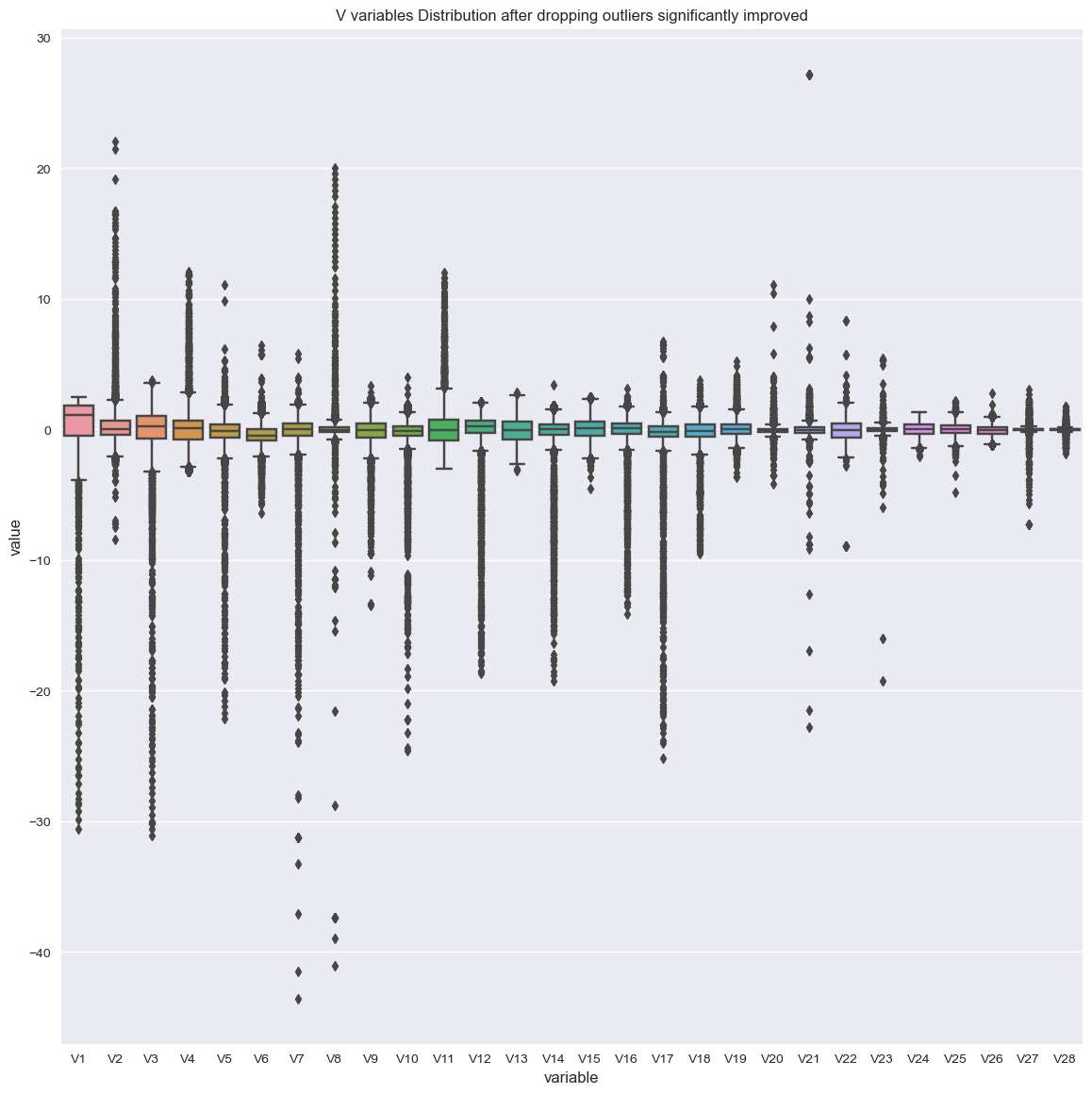

visualize the correlation again:

plt.figure(figsize=(14, 14))

vs = [col for col in data.columns if col.startswith("V")]

sns.boxplot(x="variable", y="value", data=pd.melt(outliers_removed[vs])).set(title="V variables Distribution after dropping outliers significantly improved")

plt.show()

Observations:

- Amount variable correlates highly compared to other variables with V20,V7,V6,V5,V4,V3,V2,V2.

- Time variable correlates negatively with V25,V15,V11,V3.

- Other variables don’t correlate with each other or the Vs variables since they are reduced with PCA and represent interaction with features.

- Independent variables, V11, V4, V2, V21m V19, V20, V8 correlated positively with the independent variable

- The correlation between the target variable and the independent variables improved after dropping outliers, but still we might risk removing information from the data, its hard to decide to keep or remove outliers since many outliers can be informative outliers, and we can’t take such decision without domain knowledge.

- The density distribution of the data for the numerical variables shows non-linear separation boundary by separation.

- Projecting data on 3D space with PCA shows that the data is not linearly separable and there is a pattern shared among or clusters in the data. for fraud class.

- The data is still heavily imbalanced.

- There are no missing values in the data.

Statistical Analysis

data.drop("ID",axis=1,inplace=True,errors="ignore")

# Split the data into train and test sets with fixed random state:

X = data.drop(['Class'], axis=1)

y = data['Class']

# split data into training and testing:

x_train, x_test, y_train, y_test = train_test_split(X, y, test_size=0.3, random_state=42)

# Fit a logistic regression model using Statsmodels

X = sm.add_constant(X) # Add a constant term to the feature matrix

result = sm.Logit(y, X).fit()

# Print the model summary:

print(result.summary())

Optimization terminated successfully.

Current function value: 0.003914

Iterations 13

Logit Regression Results

==============================================================================

Dep. Variable: Class No. Observations: 284807

Model: Logit Df Residuals: 284776

Method: MLE Df Model: 30

Date: Wed, 28 Jun 2023 Pseudo R-squ.: 0.6922

Time: 16:12:06 Log-Likelihood: -1114.8

converged: True LL-Null: -3621.2

Covariance Type: nonrobust LLR p-value: 0.000

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const -8.3917 0.249 -33.652 0.000 -8.880 -7.903

Time -3.742e-06 2.26e-06 -1.659 0.097 -8.16e-06 6.79e-07

V1 0.0960 0.042 2.264 0.024 0.013 0.179

V2 0.0094 0.058 0.161 0.872 -0.104 0.123

V3 -0.0079 0.053 -0.149 0.881 -0.112 0.096

V4 0.6986 0.074 9.454 0.000 0.554 0.843

V5 0.1295 0.067 1.944 0.052 -0.001 0.260

V6 -0.1198 0.074 -1.626 0.104 -0.264 0.025

V7 -0.0969 0.067 -1.453 0.146 -0.228 0.034

V8 -0.1739 0.030 -5.711 0.000 -0.234 -0.114

V9 -0.2843 0.111 -2.561 0.010 -0.502 -0.067

V10 -0.8176 0.097 -8.432 0.000 -1.008 -0.628

V11 -0.0621 0.081 -0.762 0.446 -0.222 0.098

V12 0.0909 0.087 1.045 0.296 -0.080 0.261

V13 -0.3312 0.082 -4.058 0.000 -0.491 -0.171

V14 -0.5571 0.062 -8.949 0.000 -0.679 -0.435

V15 -0.1141 0.086 -1.330 0.183 -0.282 0.054

V16 -0.1908 0.125 -1.526 0.127 -0.436 0.054

V17 -0.0216 0.070 -0.309 0.757 -0.159 0.116

V18 -0.0131 0.129 -0.102 0.919 -0.266 0.240

V19 0.0963 0.097 0.993 0.321 -0.094 0.286

V20 -0.4582 0.082 -5.607 0.000 -0.618 -0.298

V21 0.3898 0.060 6.494 0.000 0.272 0.507

V22 0.6297 0.134 4.707 0.000 0.367 0.892

V23 -0.0951 0.058 -1.629 0.103 -0.209 0.019

V24 0.1289 0.147 0.874 0.382 -0.160 0.418

V25 -0.0761 0.131 -0.582 0.560 -0.332 0.180

V26 0.0195 0.190 0.103 0.918 -0.352 0.392

V27 -0.8188 0.122 -6.686 0.000 -1.059 -0.579

V28 -0.2937 0.088 -3.332 0.001 -0.467 -0.121

Amount 0.0009 0.000 2.449 0.014 0.000 0.002

==============================================================================

Possibly complete quasi-separation: A fraction 0.31 of observations can be

perfectly predicted. This might indicate that there is complete

quasi-separation. In this case some parameters will not be identified.

statistical_results_as_frame = get_dataframe_from_summary(result)

statistical_results_as_frame[statistical_results_as_frame["P>|z|"] <= 0.000].style.background_gradient(cmap='summer')

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | -8.391700 | 0.249000 | -33.652000 | 0.000000 | -8.880000 | -7.903000 |

| V4 | 0.698600 | 0.074000 | 9.454000 | 0.000000 | 0.554000 | 0.843000 |

| V8 | -0.173900 | 0.030000 | -5.711000 | 0.000000 | -0.234000 | -0.114000 |

| V10 | -0.817600 | 0.097000 | -8.432000 | 0.000000 | -1.008000 | -0.628000 |

| V13 | -0.331200 | 0.082000 | -4.058000 | 0.000000 | -0.491000 | -0.171000 |

| V14 | -0.557100 | 0.062000 | -8.949000 | 0.000000 | -0.679000 | -0.435000 |

| V20 | -0.458200 | 0.082000 | -5.607000 | 0.000000 | -0.618000 | -0.298000 |

| V21 | 0.389800 | 0.060000 | 6.494000 | 0.000000 | 0.272000 | 0.507000 |

| V22 | 0.629700 | 0.134000 | 4.707000 | 0.000000 | 0.367000 | 0.892000 |

| V27 | -0.818800 | 0.122000 | -6.686000 | 0.000000 | -1.059000 | -0.579000 |

Logistic Regression “Establishing a Baseline”:

logistic_regression_model = LogisticRegression(random_state=12234526, penalty="l2", solver="newton-cholesky")

logistic_regression_model.fit(x_train, y_train)

# Predict on test data:

y_predict = logistic_regression_model.predict(x_test)

# classification report:

print(classification_report(y_test, y_predict))

precision recall f1-score support

0 1.00 1.00 1.00 85307

1 0.88 0.63 0.74 136

accuracy 1.00 85443

macro avg 0.94 0.82 0.87 85443

weighted avg 1.00 1.00 1.00 85443

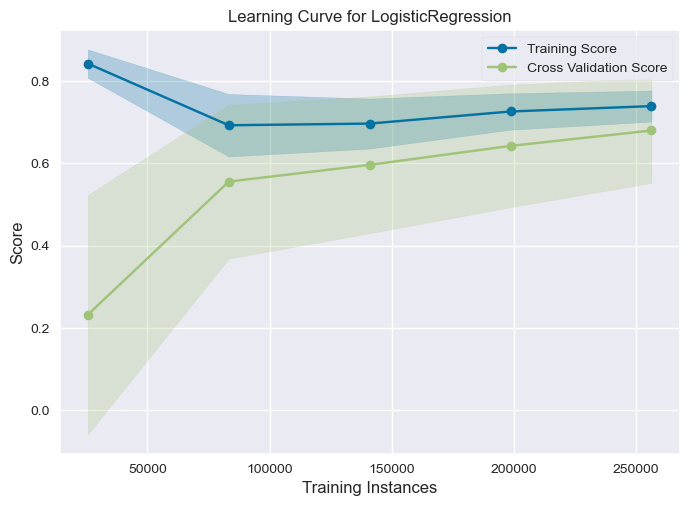

ge_learning_curve(logistic_regression_model, X, y, cv=10, scoring='f1')

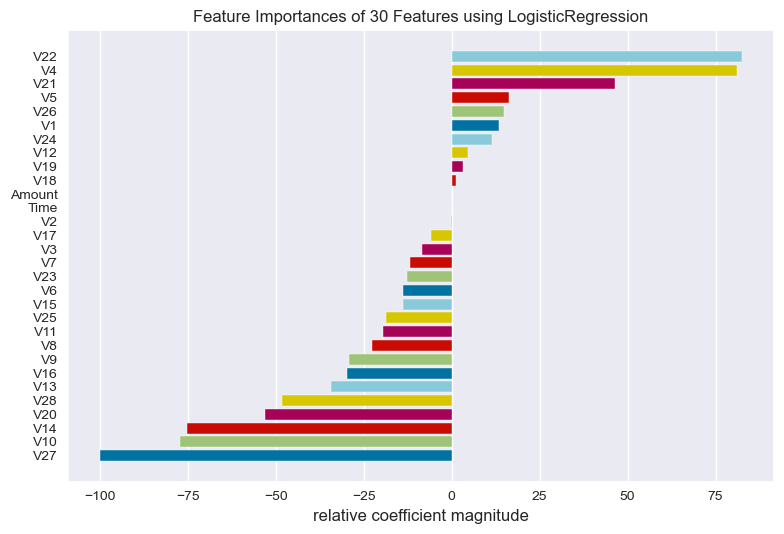

get_FeatureImportances(logistic_regression_model, x_train, y_train)

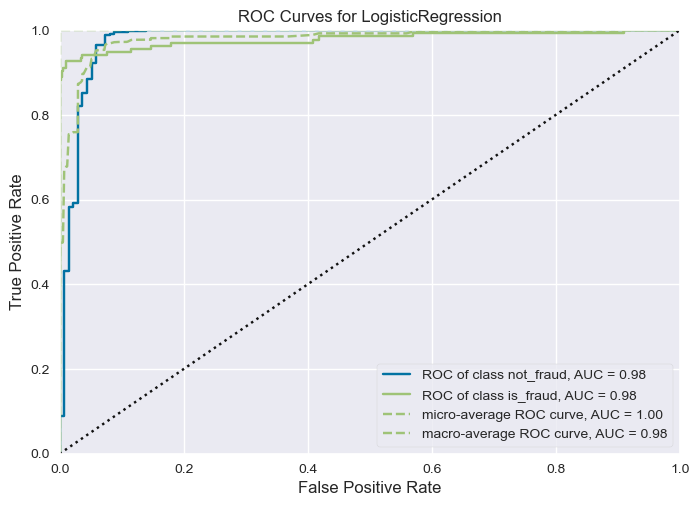

get_ROCAUC(logistic_regression_model, x_train, y_train, x_test, y_test, classes=["not_fraud", "is_fraud"])

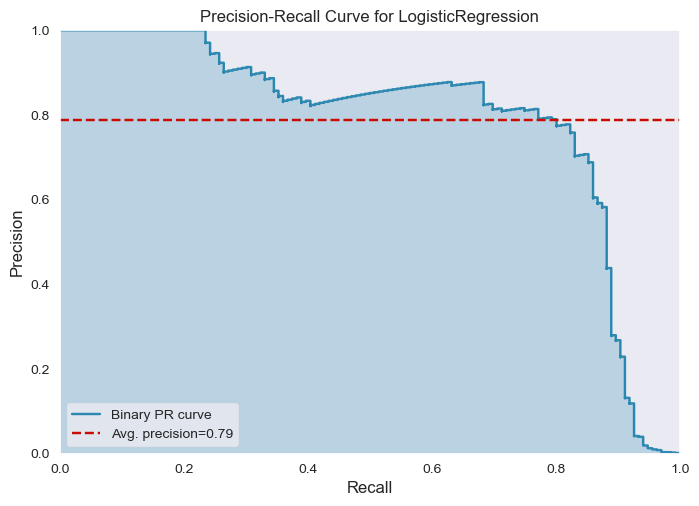

get_PrecisionRecallCurve(logistic_regression_model, x_train, y_train, x_test, y_test)

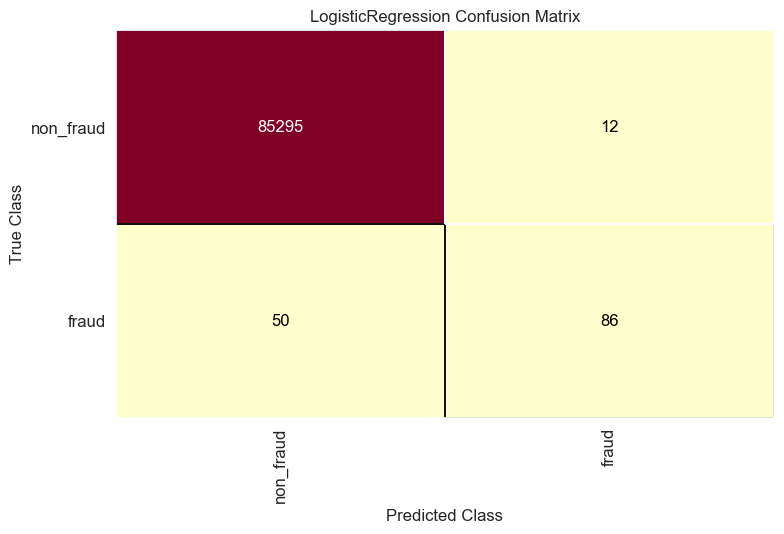

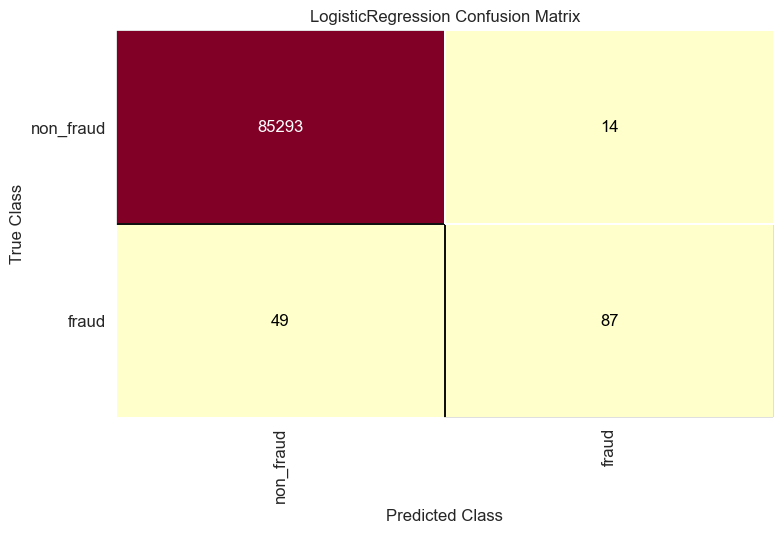

get_ConfusionMatrix(logistic_regression_model, x_train, y_train, x_test, y_test)

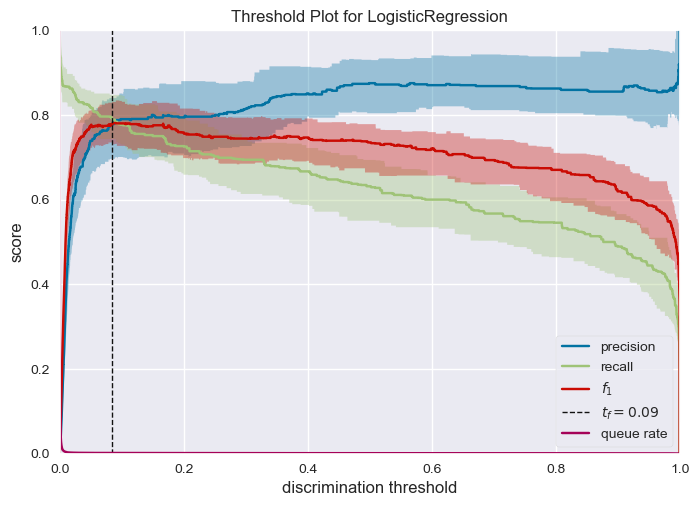

get_DiscriminationThreshold(logistic_regression_model, X, y)

Recursive Feature Elimination

Let’s try to improve the model by eliminating features and employing feature selection techniques:

rfe = RFE(logistic_regression_model)

fit = rfe.fit(X, y)

selected_features = X.columns[fit.support_].tolist()

selected_features

['V4',

'V6',

'V8',

'V9',

'V10',

'V13',

'V14',

'V16',

'V20',

'V21',

'V22',

'V23',

'V25',

'V27',

'V28']

reduced_features_train = x_train[selected_features]

reduced_features_test = x_test[selected_features]

logistic_regression_model.fit(reduced_features_train, y_train)

# Predict on test data:

y_predict_reduced = logistic_regression_model.predict(reduced_features_test)

print(classification_report(y_test, y_predict_reduced))

precision recall f1-score support

0 1.00 1.00 1.00 85307

1 0.86 0.64 0.73 136

accuracy 1.00 85443

macro avg 0.93 0.82 0.87 85443

weighted avg 1.00 1.00 1.00 85443

get_ConfusionMatrix(logistic_regression_model, reduced_features_train, y_train, reduced_features_test, y_test)

Under-Sampling the Majority Class “Non-Fraud”:

where we employ under sampling to balance the data and remove redundant data points in a highly imbalanced dataset:

# calculate the percentage of fraud cases:

value_counts = pd.Series(y).value_counts()

percentages = value_counts / len(y) * 100

print(percentages)

0 99.827251

1 0.172749

Name: Class, dtype: float64

# randomly under-sample the majority class with a given ratio:

rus = RandomUnderSampler(random_state=0, sampling_strategy = 0.4 / 100)

X_resampled, y_resampled = rus.fit_resample(X, y)

y_resampled.value_counts()

0 123000

1 492

Name: Class, dtype: int64

# split data into training and testing:

x_train_resampled, x_test_resampled, y_train_resampled, y_test_resampled = train_test_split(X_resampled, y_resampled, test_size=0.3, random_state=42)

# fit model with same parameters and random state:

logistic_regression_model.fit(x_train_resampled, y_train_resampled)

# Predict on test data:

y_predict_resampled = logistic_regression_model.predict(x_test_resampled)

# classification report:

print(classification_report(y_test_resampled, y_predict_resampled))

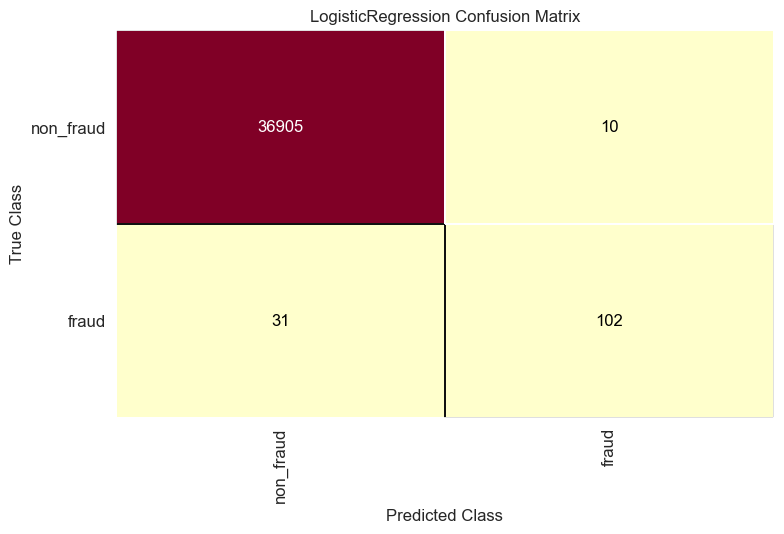

get_ConfusionMatrix(logistic_regression_model, x_train_resampled, y_train_resampled, x_test_resampled, y_test_resampled)

precision recall f1-score support

0 1.00 1.00 1.00 36915

1 0.91 0.77 0.83 133

accuracy 1.00 37048

macro avg 0.95 0.88 0.92 37048

weighted avg 1.00 1.00 1.00 37048

Observations:

- Fitting simple statistical linear model shows significant features that forms a good predictors of fraud class, V4,V8,V10,V13,V14,V20,V21,V22 and V27.

- Pseudo R-squ: 0.6922 shows that the model is a average fit for the data.

- Logistic regression model is a good baseline model for this dataset, with recall 0.63 for fraud class, we want to capture fraud cases as much as possible.

- Overall F1-score is 0.87, which is a good score for a baseline model but still what is relevant is the F1-score for fraud class since the data is heavily imbalanced.

- The learning curve for 5-fold cross validation shows that the model is not over-fitting.

- Most important features are V22,V4,V21,V5,V26,V1,V24,V12,V19,V18, Amount and Time almost has not affect on fraud class.

- ROC-AUC curve shows that the model is a good fit for the data but still irrelevant since the data is imbalanced.

- Model predicted 86 fraud transaction or the true-positive and missed 50 fraud transaction or the false-negative.

- Most important insight to highlight is probability threshold for predicting class fraud is 0.10, if we suspect with low probability if the model is fraud we can investigate further.

- Feature selection with elimination method resulting in 15 features increases the fraud detection by 1 only from 86 to 87.

- Under-sampling the majority class “Non-Fraud” to 0.4% of the data, increases the fraud detection from 87 to 102 but still we might risk losing information from the original distribution of the data we can not take such decision without further domain knowledge about the meaning of the variables introduced in the data.

Complex Model:

# Set the scale_pos_weight parameter:

scale_pos_weight = (y_train == 0).sum() / (y_train == 1).sum()

# Create a LightGBM dataset object

dtrain = lgb.Dataset(x_train, label=y_train)

# Set the hyper-parameters help us approach the imbalanced data:

params = {

'boosting_type': 'gbdt',

'objective': 'binary',

# 'scale_pos_weight': scale_pos_weight,

}

lightgbm_model = LGBMClassifier(

# **params,verbose=100,

# n_estimators=len(X.columns),

# is_unbalance=True,

num_leaves=100,

max_depth=100,

# learning_rate=0.001,

)

# Train the model

lightgbm_model.fit(x_train, y_train)

# Make predictions on the validation set

y_pred = lightgbm_model.predict(x_test)

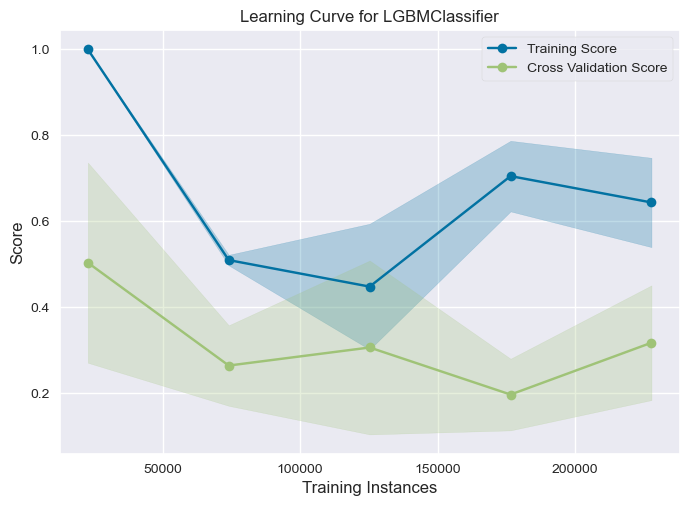

ge_learning_curve(lightgbm_model, X, y, cv=5, scoring='f1')

print(classification_report(y_test, y_pred))

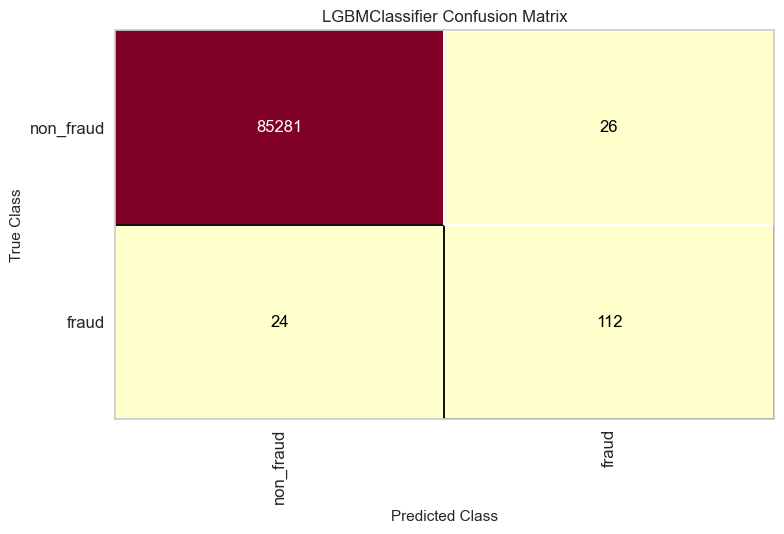

get_ConfusionMatrix(lightgbm_model, x_train, y_train, x_test, y_test)

feature_importance_plot(lightgbm_model.feature_importances_, x_train.columns.tolist())

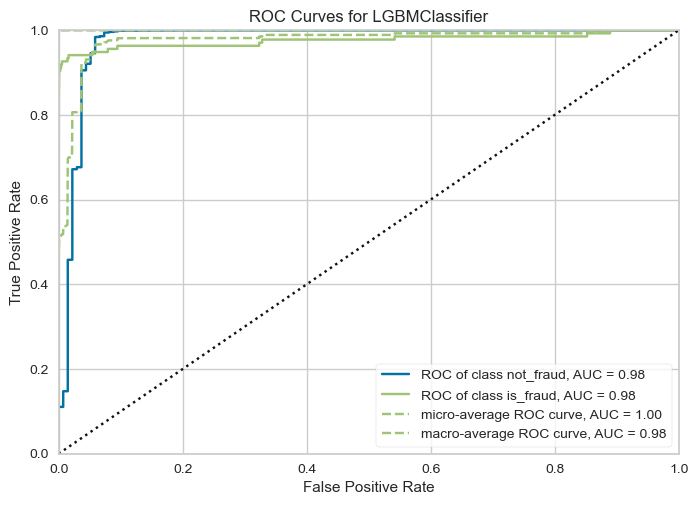

get_ROCAUC(lightgbm_model, x_train, y_train, x_test, y_test, classes=["not_fraud", "is_fraud"])

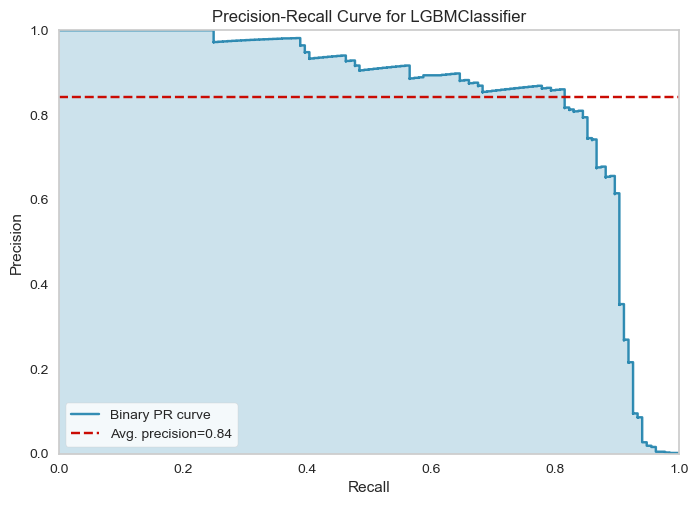

get_PrecisionRecallCurve(lightgbm_model, x_train, y_train, x_test, y_test)

precision recall f1-score support

0 1.00 1.00 1.00 85307

1 0.81 0.82 0.82 136

accuracy 1.00 85443

macro avg 0.91 0.91 0.91 85443

weighted avg 1.00 1.00 1.00 85443

lightgbm_model_test = LGBMClassifier()

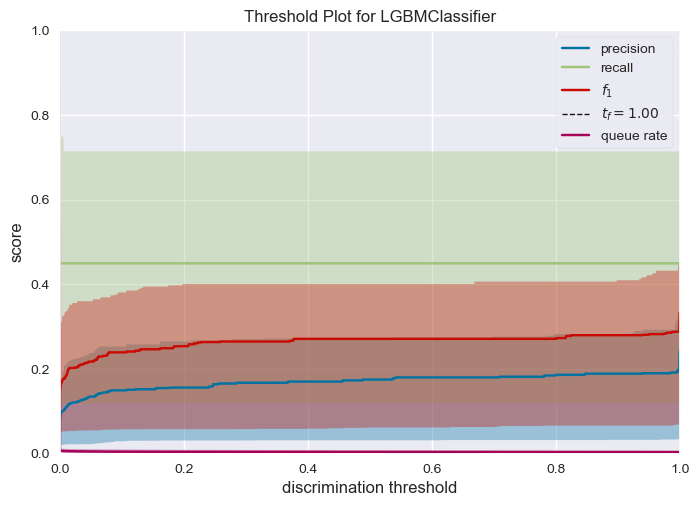

get_DiscriminationThreshold(lightgbm_model_test, x_test, y_test)

Observations:

- Lightgbm model is able to capture more fraud transactions with F1 score of 0.82.

- Learning curve shows the model is unstable over 5-fold cross validation, it comes from the fact that the data is imbalanced.

- Frauds detection increase to 112 from 87 without under-sampling the majority class.

- Deciding a threshold for is difficult for lightgbm it’s the case generally for boosting models, they do not offer a well calibrated probability as compared to logistic regression.

lightgbm_model.fit(X_resampled, y_resampled)

calibrated_clf = CalibratedClassifierCV(lightgbm_model, cv='prefit', method='sigmoid')

calibrated_clf.fit(X_resampled, y_resampled)

CalibratedClassifierCV(cv='prefit',estimator=LGBMClassifier(max_depth=100, num_leaves=100))</pre><b>In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. <br />On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.</b></div><div class="sk-container" hidden><div class="sk-item sk-dashed-wrapped"><div class="sk-label-container"><div class="sk-label sk-toggleable"><input class="sk-toggleable__control sk-hidden--visually" id="sk-estimator-id-1" type="checkbox" ><label for="sk-estimator-id-1" class="sk-toggleable__label sk-toggleable__label-arrow">CalibratedClassifierCV</label><div class="sk-toggleable__content"><pre>CalibratedClassifierCV(cv='prefit', estimator=LGBMClassifier(max_depth=100, num_leaves=100))</pre></div></div></div><div class="sk-parallel"><div class="sk-parallel-item"><div class="sk-item"><div class="sk-label-container"><div class="sk-label sk-toggleable"><input class="sk-toggleable__control sk-hidden--visually" id="sk-estimator-id-2" type="checkbox" ><label for="sk-estimator-id-2" class="sk-toggleable__label sk-toggleable__label-arrow">estimator: LGBMClassifier</label><div class="sk-toggleable__content"><pre>LGBMClassifier(max_depth=100, num_leaves=100)</pre></div></div></div><div class="sk-serial"><div class="sk-item"><div class="sk-estimator sk-toggleable"><input class="sk-toggleable__control sk-hidden--visually" id="sk-estimator-id-3" type="checkbox" ><label for="sk-estimator-id-3" class="sk-toggleable__label sk-toggleable__label-arrow">LGBMClassifier</label><div class="sk-toggleable__content"><pre>LGBMClassifier(max_depth=100, num_leaves=100)</pre></div></div></div></div></div></div></div></div></div></div>final_results = X_resampled.copy() final_results['y'] = y_resampled final_results['probability_fraud'] = calibrated_clf.predict_proba(X_resampled)[:, 1] final_results['probability_non_fraud'] = calibrated_clf.predict_proba(X_resampled)[:, 0] final_results['probability_fraud_logi'] = logistic_regression_model.predict_proba(X_resampled)[:, 1] final_results['probability_non_fraud_logi'] = logistic_regression_model.predict_proba(X_resampled)[:, 0]frauds_indexes = y_resampled.loc[y_resampled == 1].index X_resampled_fraud = X_resampled.loc[frauds_indexes] frauds_indexes_list = frauds_indexes.tolist()Explainable AI

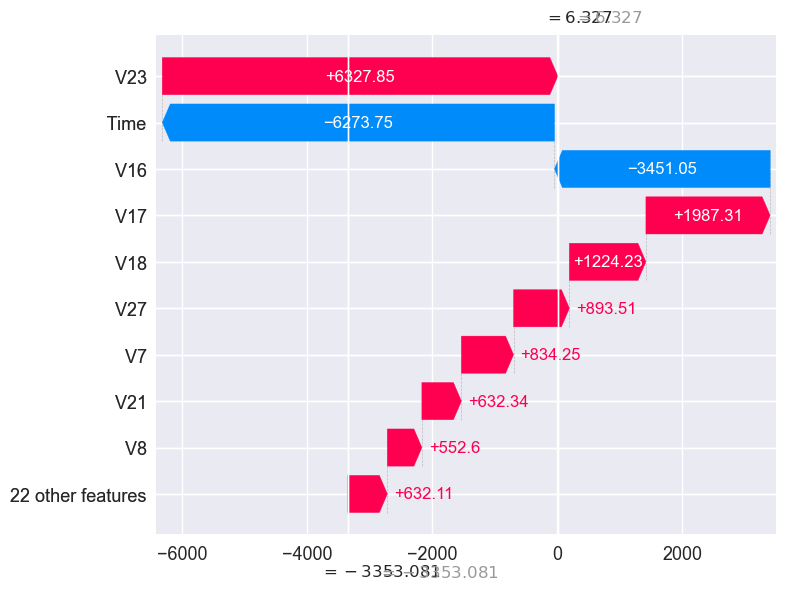

Where we explain the model predictions performed by lightgbm model:

shap.initjs() explainer = shap.TreeExplainer(lightgbm_model) shap_values = explainer.shap_values(X_resampled, y_resampled, check_additivity=False)

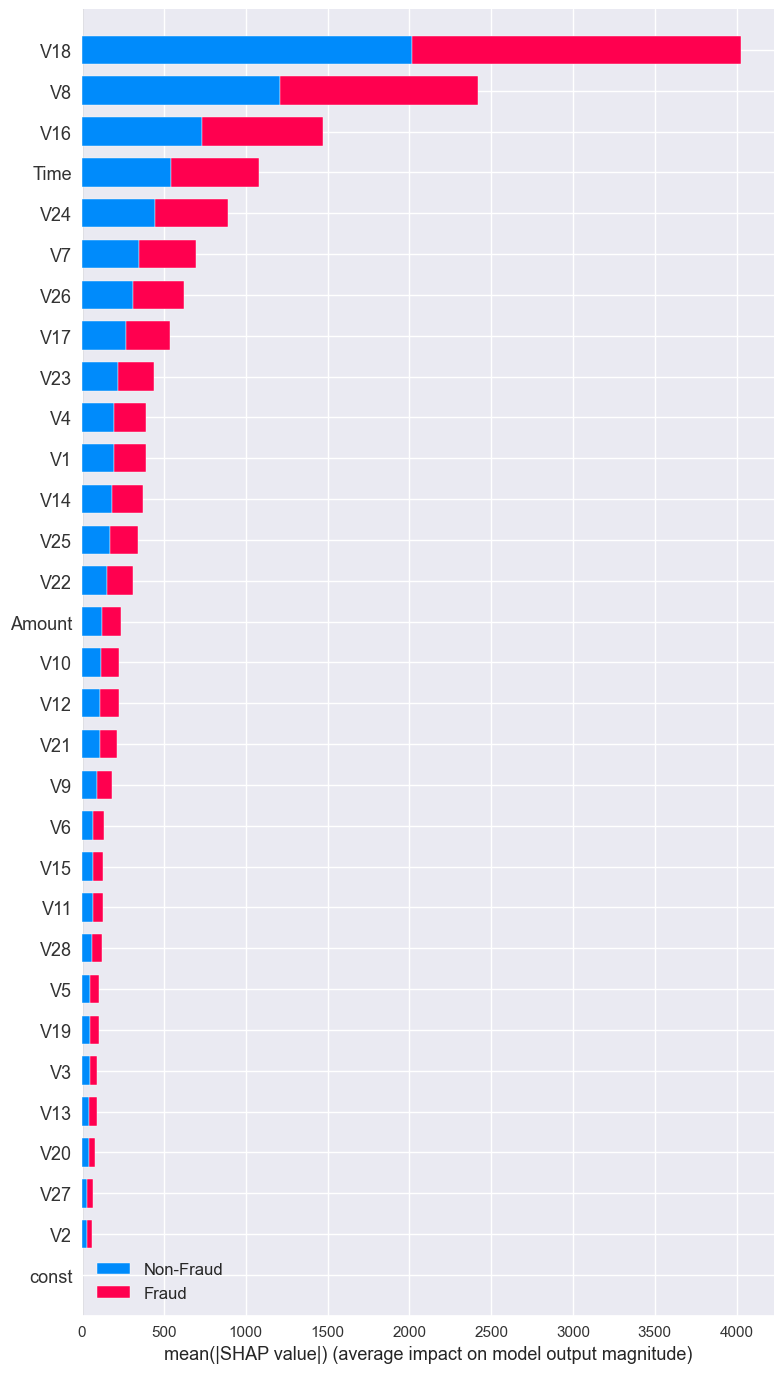

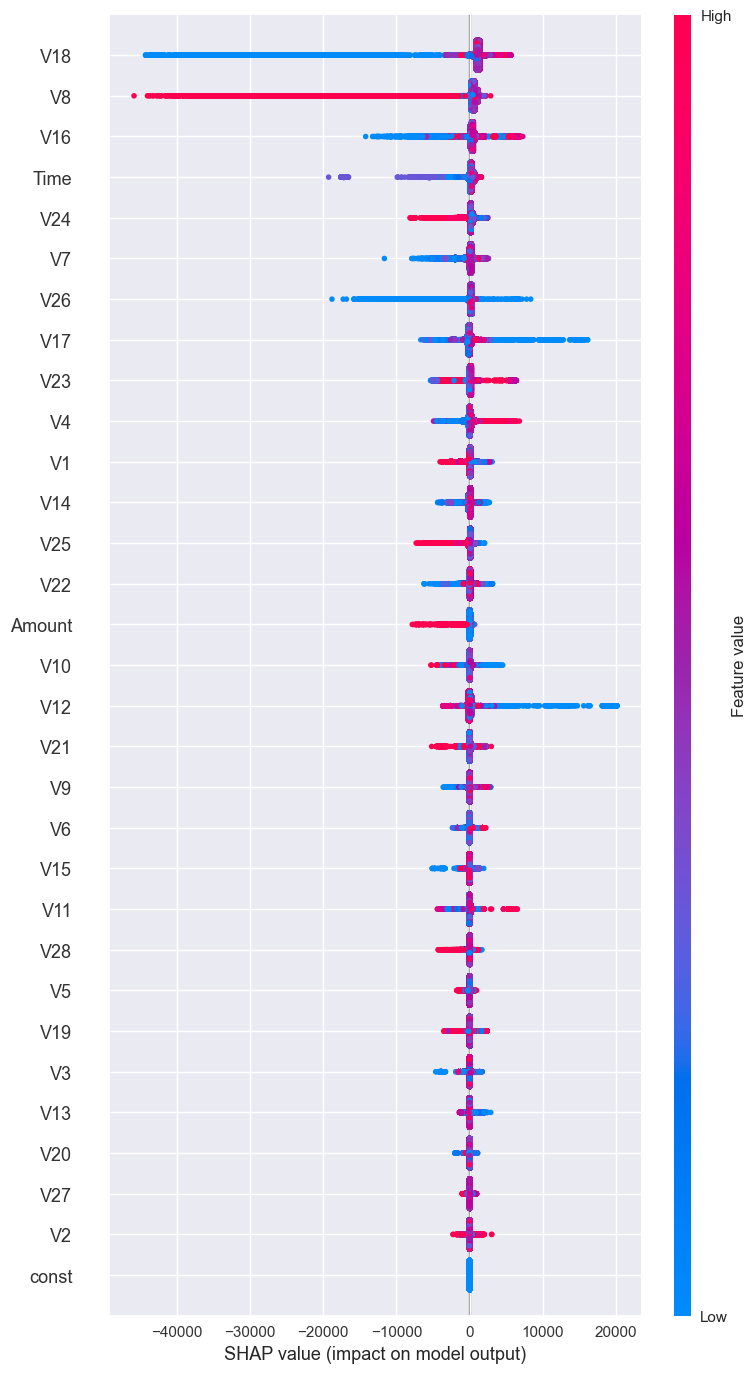

Explainable AI:

shap.summary_plot(shap_values, X_resampled, max_display=len(X.index),class_names=['Non-Fraud', 'Fraud'])

# impact of Fraud on the model:

shap.summary_plot(shap_values[1],

X_resampled,

max_display=len(X_resampled.index),

class_names=['Non-Fraud', 'Fraud'])

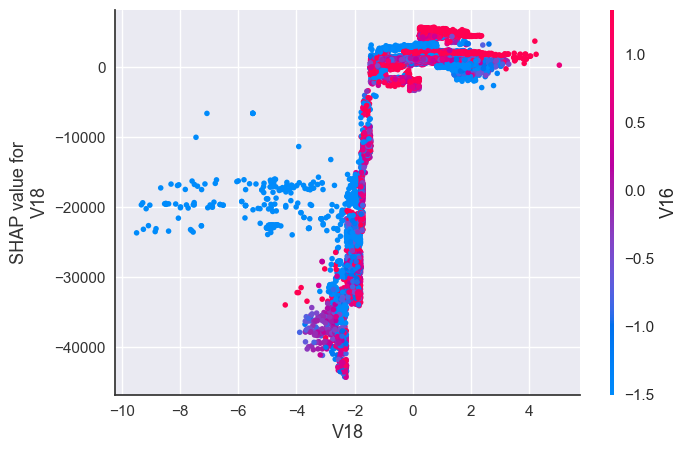

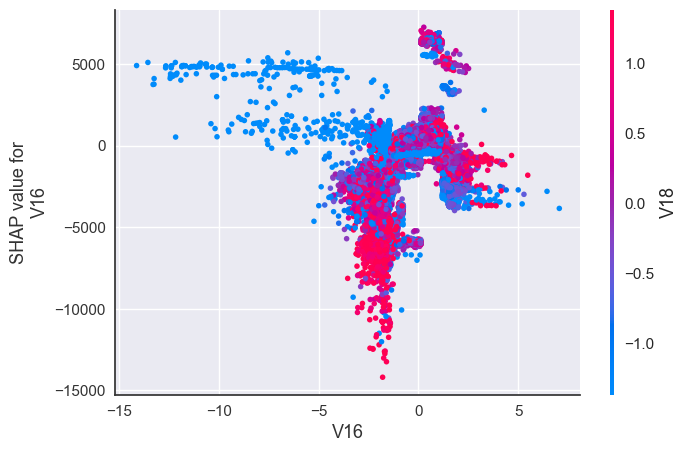

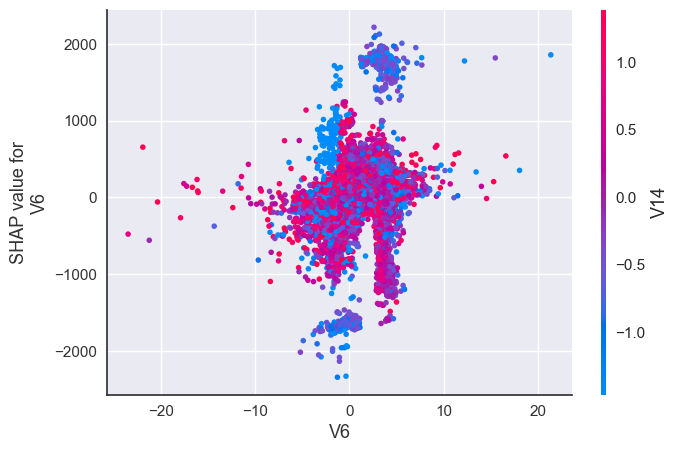

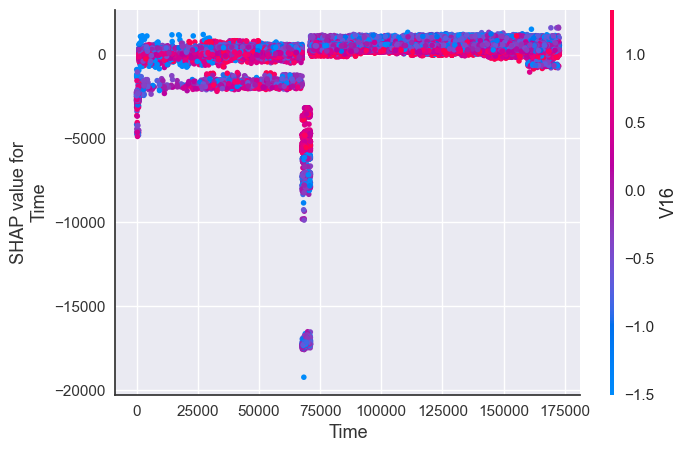

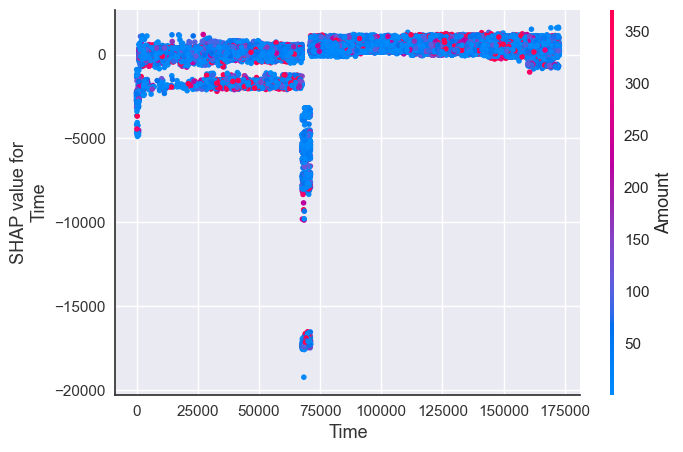

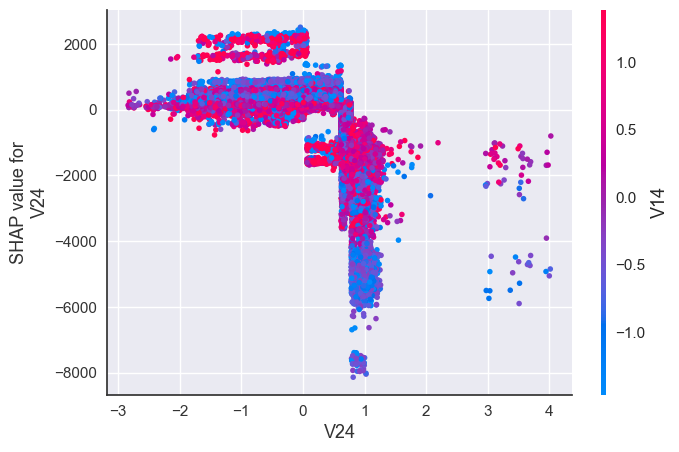

Interaction between most impactful features for Fraud transactions:

shap.dependence_plot("V18", shap_values[1], X_resampled)

shap.dependence_plot("V16", shap_values[1], X_resampled)

shap.dependence_plot("V6", shap_values[1], X_resampled)

shap.dependence_plot("Time", shap_values[1], X_resampled)

shap.dependence_plot("Time", shap_values[1], X_resampled, interaction_index="Amount")

shap.dependence_plot("V24", shap_values[1], X_resampled)

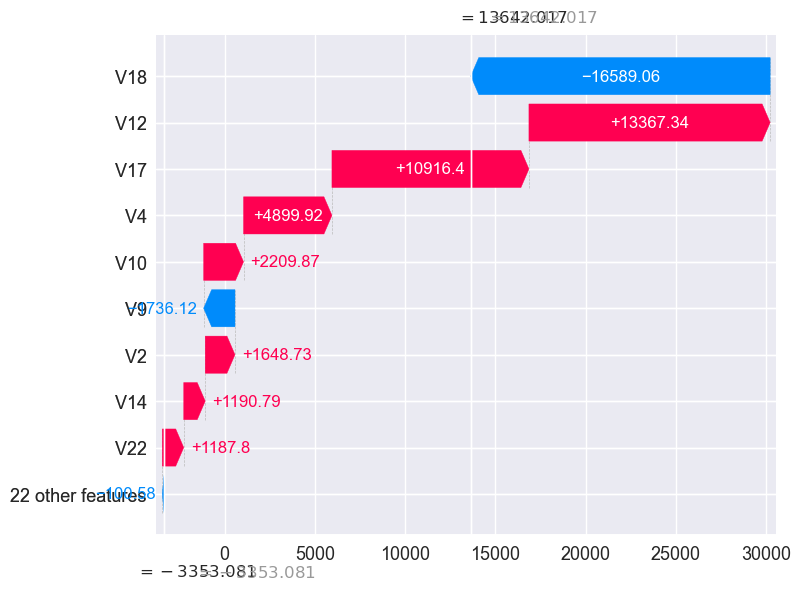

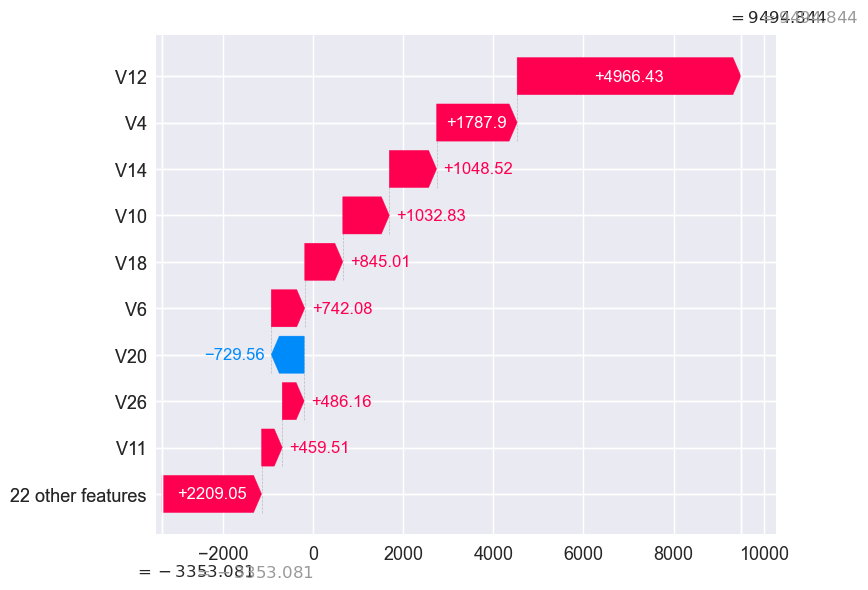

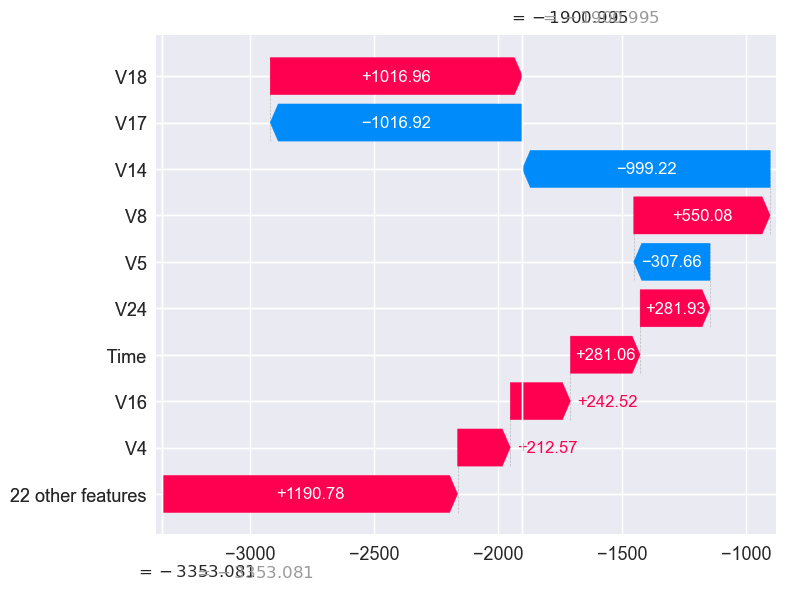

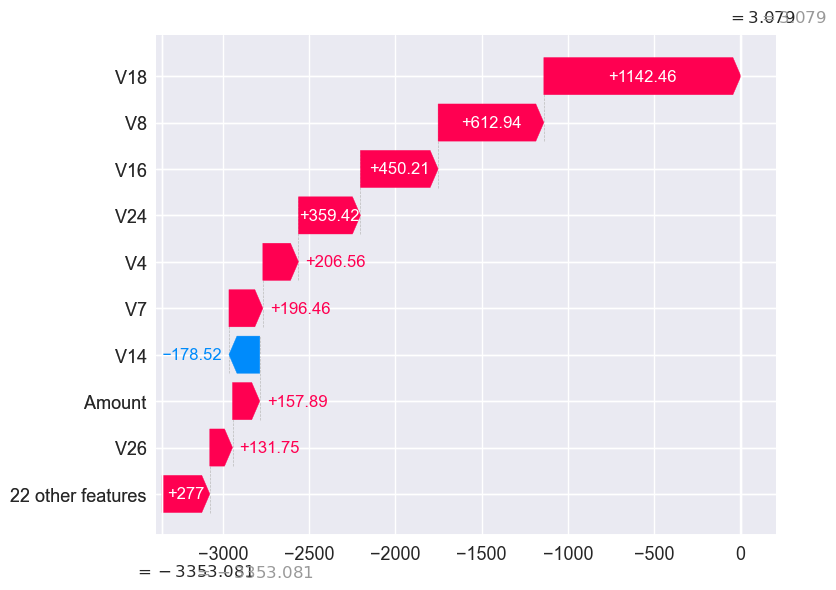

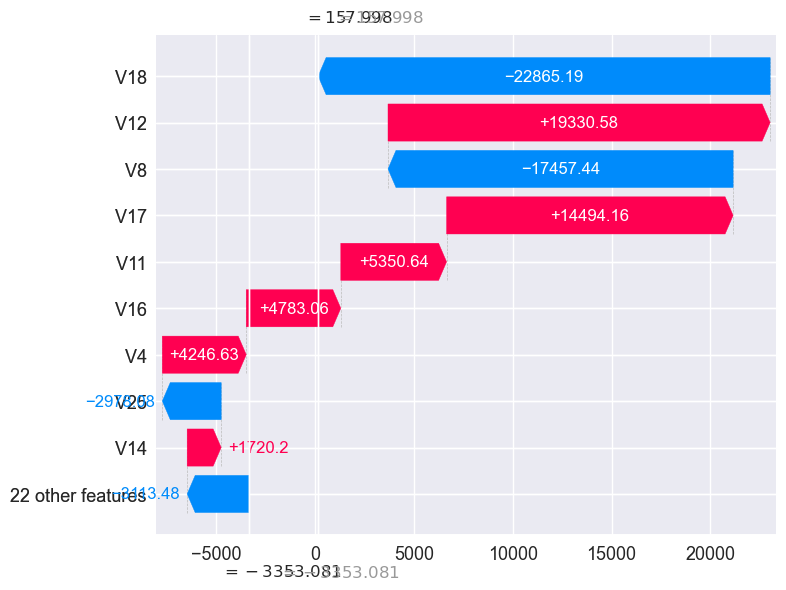

Local Explanations of randomly chosen frauds transactions:

choose_random_fraud= random.sample(frauds_indexes_list, 1)[0]

shap.plots._waterfall.waterfall_legacy(explainer.expected_value[1],

shap_values[1][choose_random_fraud],

X_resampled.iloc[choose_random_fraud],

X_resampled.columns)

final_results.loc[choose_random_fraud]

const 1.000000e+00

Time 1.839900e+04

V1 -1.447444e+01

V2 6.503185e+00

V3 -1.771263e+01

V4 1.127035e+01

V5 -4.150142e+00

V6 -3.372098e+00

V7 -1.653581e+01

V8 -1.443947e+00

V9 -6.815273e+00

V10 -1.367055e+01

V11 1.054526e+01

V12 -1.502270e+01

V13 1.716331e-01

V14 -1.506637e+01

V15 -2.595759e-01

V16 -8.668739e+00

V17 -1.280414e+01

V18 -5.116620e+00

V19 5.792004e-01

V20 1.101250e+00

V21 -2.475962e+00

V22 3.423907e-01

V23 -3.564508e+00

V24 -8.181402e-01

V25 1.534077e-01

V26 7.550795e-01

V27 2.706566e+00

V28 -9.929160e-01

Amount 1.000000e+00

y 1.000000e+00

probability_fraud 5.165918e-01

probability_non_fraud 4.834082e-01

probability_fraud_logi 1.000000e+00

probability_non_fraud_logi 1.817857e-11

Name: 123045, dtype: float64

choose_random_fraud= random.sample(frauds_indexes_list, 1)[0]

shap.plots._waterfall.waterfall_legacy(explainer.expected_value[1],

shap_values[1][choose_random_fraud],

X_resampled.iloc[choose_random_fraud],

X_resampled.columns)

final_results.loc[choose_random_fraud]

const 1.000000

Time 42474.000000

V1 -3.843009

V2 3.375110

V3 -5.492893

V4 6.136378

V5 2.797195

V6 -2.646162

V7 -1.668931

V8 -2.617552

V9 -3.945843

V10 -4.565252

V11 4.097216

V12 -5.450916

V13 -0.965693

V14 -10.904459

V15 0.526948

V16 -1.139754

V17 0.835640

V18 0.389774

V19 -1.439608

V20 0.054796

V21 -1.277812

V22 0.719652

V23 0.451125

V24 -0.258094

V25 0.656129

V26 0.556676

V27 0.739383

V28 -0.203050

Amount 1.000000

y 1.000000

probability_fraud 0.516592

probability_non_fraud 0.483408

probability_fraud_logi 0.999935

probability_non_fraud_logi 0.000065

Name: 123142, dtype: float64

choose_random_fraud= random.sample(frauds_indexes_list, 1)[0]

shap.plots._waterfall.waterfall_legacy(explainer.expected_value[1],

shap_values[1][choose_random_fraud],

X_resampled.iloc[choose_random_fraud],

X_resampled.columns)

final_results.loc[choose_random_fraud]

const 1.000000

Time 142280.000000

V1 -1.169203

V2 1.863414

V3 -2.515135

V4 5.463681

V5 -0.297971

V6 1.364918

V7 0.759219

V8 -0.118861

V9 -2.293921

V10 -0.423784

V11 2.375876

V12 -3.244827

V13 -0.556619

V14 -5.152475

V15 0.050906

V16 -1.022045

V17 -1.646505

V18 0.126460

V19 1.819013

V20 -0.299374

V21 -0.393090

V22 -0.708692

V23 0.471309

V24 -0.078616

V25 -0.544655

V26 0.014777

V27 -0.240930

V28 -0.781055

Amount 324.590000

y 1.000000

probability_fraud 0.000681

probability_non_fraud 0.999319

probability_fraud_logi 0.650992

probability_non_fraud_logi 0.349008

Name: 123406, dtype: float64

choose_random_fraud= random.sample(frauds_indexes_list, 1)[0]

shap.plots._waterfall.waterfall_legacy(explainer.expected_value[1],

shap_values[1][choose_random_fraud],

X_resampled.iloc[choose_random_fraud],

X_resampled.columns)

final_results.loc[choose_random_fraud]

const 1.000000

Time 45501.000000

V1 1.001992

V2 0.047938

V3 -0.349002

V4 1.493958

V5 0.186939

V6 0.190966

V7 -0.001112

V8 0.147140

V9 0.580415

V10 -0.792938

V11 -0.984172

V12 -0.567380

V13 -1.105592

V14 -1.381214

V15 0.405490

V16 0.279890

V17 1.132160

V18 0.092993

V19 -0.298920

V20 0.016004

V21 -0.334417

V22 -1.014315

V23 -0.128427

V24 -0.946242

V25 0.456090

V26 -0.453206

V27 0.046627

V28 0.064698

Amount 105.990000

y 1.000000

probability_fraud 0.436079

probability_non_fraud 0.563921

probability_fraud_logi 0.003123

probability_non_fraud_logi 0.996877

Name: 123151, dtype: float64

choose_random_fraud= random.sample(frauds_indexes_list, 1)[0]

shap.plots._waterfall.waterfall_legacy(explainer.expected_value[1],

shap_values[1][choose_random_fraud],

X_resampled.iloc[choose_random_fraud],

X_resampled.columns)

final_results.loc[choose_random_fraud]

const 1.000000

Time 25254.000000

V1 -17.275191

V2 10.819665

V3 -20.363886

V4 6.046612

V5 -13.465033

V6 -4.166647

V7 -14.409448

V8 11.580797

V9 -4.073856

V10 -9.153368

V11 6.210883

V12 -8.778572

V13 -0.061367

V14 -9.574662

V15 0.049289

V16 -7.418487

V17 -14.102772

V18 -5.016423

V19 1.390314

V20 1.544970

V21 1.729804

V22 -1.208096

V23 -0.726839

V24 0.112540

V25 1.119193

V26 -0.233189

V27 1.684063

V28 0.503740

Amount 99.990000

y 1.000000

probability_fraud 0.516592

probability_non_fraud 0.483408

probability_fraud_logi 0.999939

probability_non_fraud_logi 0.000061

Name: 123059, dtype: float64

choose_random_fraud= random.sample(frauds_indexes_list, 1)[0]

shap.plots._waterfall.waterfall_legacy(explainer.expected_value[1],

shap_values[1][choose_random_fraud],

X_resampled.iloc[choose_random_fraud],

X_resampled.columns)

final_results.loc[choose_random_fraud]

const 1.000000

Time 68357.000000

V1 1.232604

V2 -0.548931

V3 1.087873

V4 0.894082

V5 -1.433055

V6 -0.356797

V7 -0.717492

V8 0.003167

V9 -0.100397

V10 0.543187

V11 -1.039417

V12 0.285262

V13 -0.206007

V14 -0.498522

V15 -1.064108

V16 -2.156037

V17 0.564761

V18 0.837857

V19 -0.728990

V20 -0.576274

V21 -0.448671

V22 -0.517568

V23 0.012833

V24 0.699217

V25 0.527258

V26 -0.322607

V27 0.080805

V28 0.035427

Amount 19.590000

y 1.000000

probability_fraud 0.513311

probability_non_fraud 0.486689

probability_fraud_logi 0.001282

probability_non_fraud_logi 0.998718

Name: 123231, dtype: float64

Insight from real values and Explainable AI values:

Prepare the data first:

# Slice by fraud transactions:

fraud_final_results = final_results[final_results["y"] == 1]

# validate that we are dealing with fraud transactions only:

fraud_final_results.index.equals(frauds_indexes)

# get shap values of fraud transactions only, 1 here refers to fraud transaction or label:

shap_values_fraud = shap_values[1][fraud_final_results.index]

shap_values_fraud = pd.DataFrame(shap_values_fraud, columns=X_resampled.columns)

shap_values_fraud.drop(columns=['const'], inplace=True,errors='ignore')

fraud_final_results.drop(columns=['const'], inplace=True,errors='ignore')

list_columns = shap_values_fraud.columns.tolist()

new_columns = [column + "_shap" for column in list_columns]

shap_values_fraud.columns = new_columns

# to make sure we are dealing with the same indexes, and help us merge the dataframes:

fraud_final_results = fraud_final_results.reset_index()

shap_values_fraud["index"] = fraud_final_results["index"]

overall_final = fraud_final_results.merge(shap_values_fraud, on="index")

overall_final["probability_fraud"] = overall_final["probability_fraud"].apply(lambda x: round(x, 4))

overall_final["probability_fraud"] = overall_final["probability_fraud"].astype(float)

# shap values should be in the positive range, it means its effecting fraud probability positively:

mean_series = overall_final.mean(axis=0)

mean_series = mean_series.sort_values(ascending=False)

mean_series

index 123245.500000

Time 80746.806911

V17_shap 8510.094384

V12_shap 8293.768162

V4_shap 2224.738310

...

V9_shap -390.242928

V19_shap -448.767418

V7_shap -555.546820

V8_shap -3842.413947

V18_shap -9396.813096

Length: 66, dtype: float64

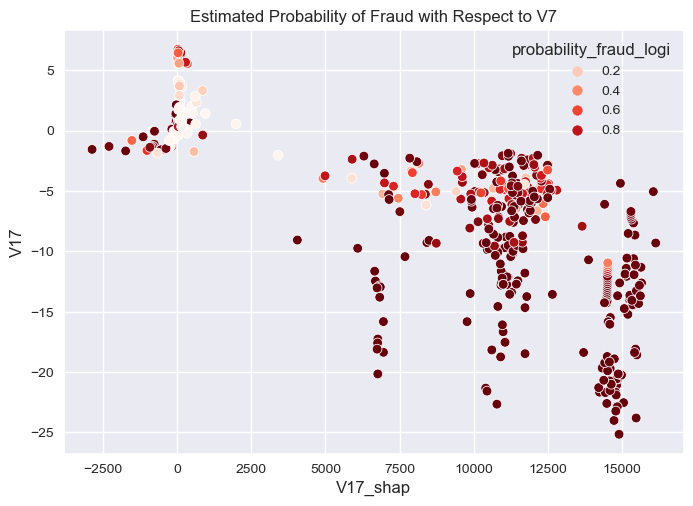

sns.scatterplot(overall_final,

y="V17",

x="V17_shap",

hue="probability_fraud_logi",

palette="Reds"

).set(title="Estimated Probability of Fraud with Respect to V7")

[Text(0.5, 1.0, 'Estimated Probability of Fraud with Respect to V7')]

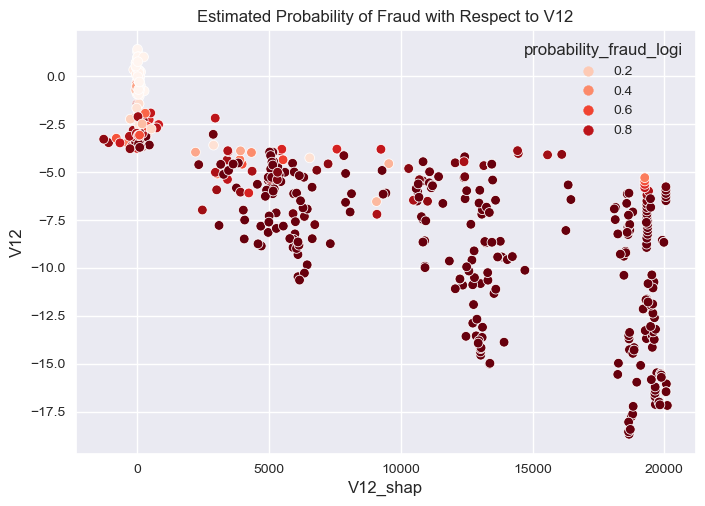

sns.scatterplot(overall_final,

y="V12",

x="V12_shap",

hue="probability_fraud_logi",

palette="Reds"

).set(title="Estimated Probability of Fraud with Respect to V12")

[Text(0.5, 1.0, 'Estimated Probability of Fraud with Respect to V12')]

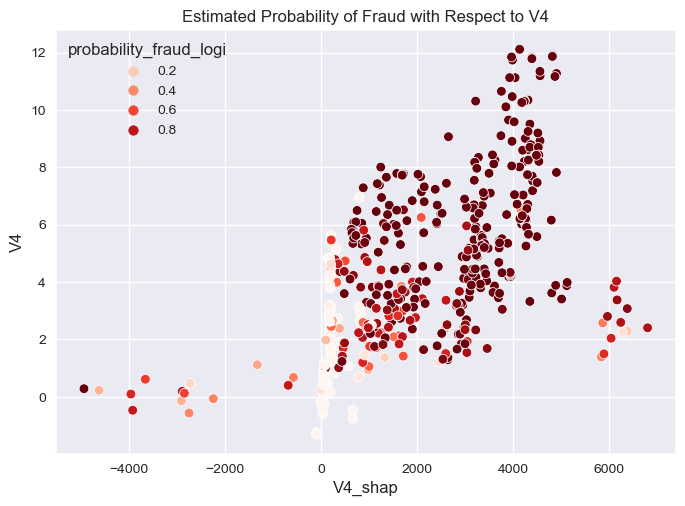

sns.scatterplot(overall_final,

y="V4",

x="V4_shap",

hue="probability_fraud_logi",

palette="Reds"

).set(title="Estimated Probability of Fraud with Respect to V4")

[Text(0.5, 1.0, 'Estimated Probability of Fraud with Respect to V4')]

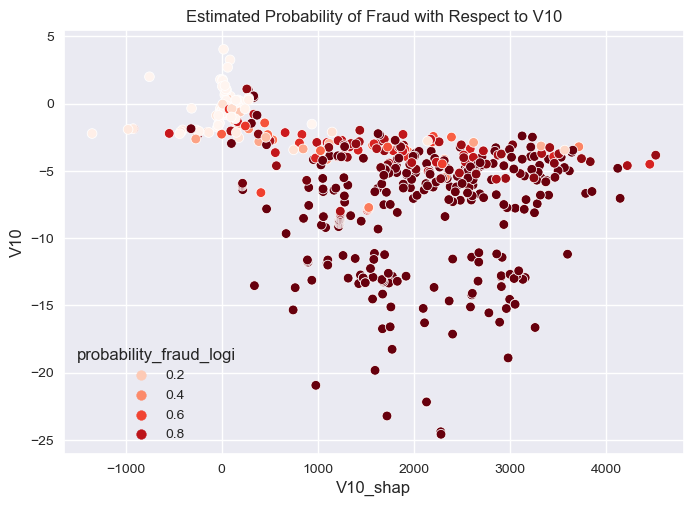

sns.scatterplot(overall_final,

y="V10",

x="V10_shap",

hue="probability_fraud_logi",

palette="Reds"

).set(title="Estimated Probability of Fraud with Respect to V10")

[Text(0.5, 1.0, 'Estimated Probability of Fraud with Respect to V10')]

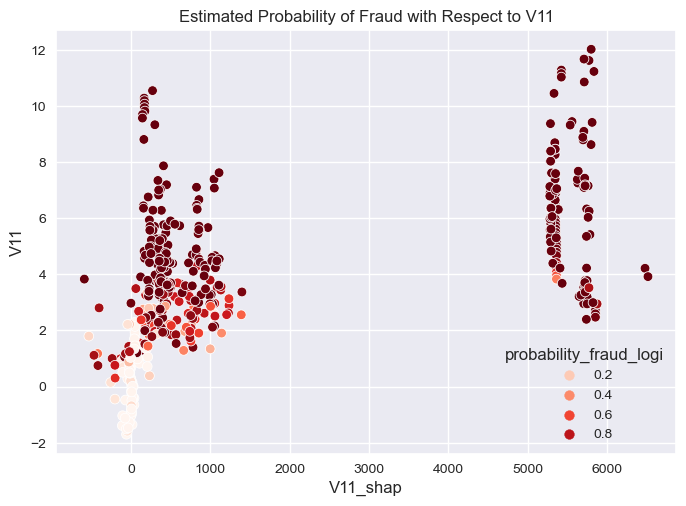

sns.scatterplot(overall_final,

y="V11",

x="V11_shap",

hue="probability_fraud_logi",

palette="Reds"

).set(title="Estimated Probability of Fraud with Respect to V11")

[Text(0.5, 1.0, 'Estimated Probability of Fraud with Respect to V11')]

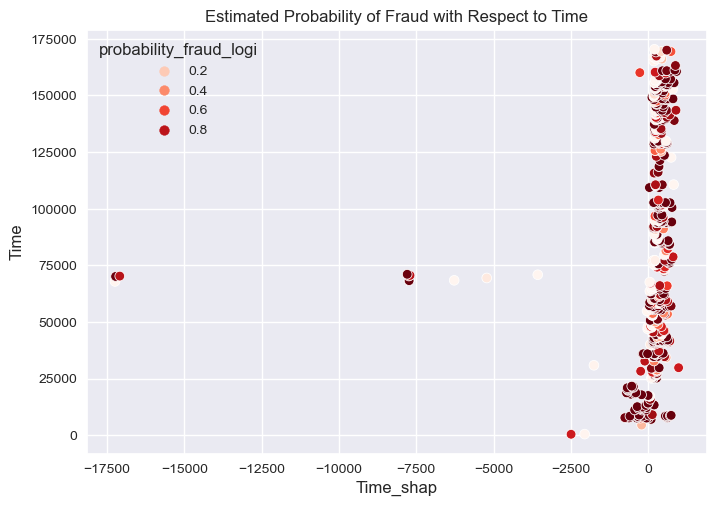

sns.scatterplot(overall_final,

y="Time",

x="Time_shap",

hue="probability_fraud_logi",

palette="Reds"

).set(title="Estimated Probability of Fraud with Respect to Time")

[Text(0.5, 1.0, 'Estimated Probability of Fraud with Respect to Time')]

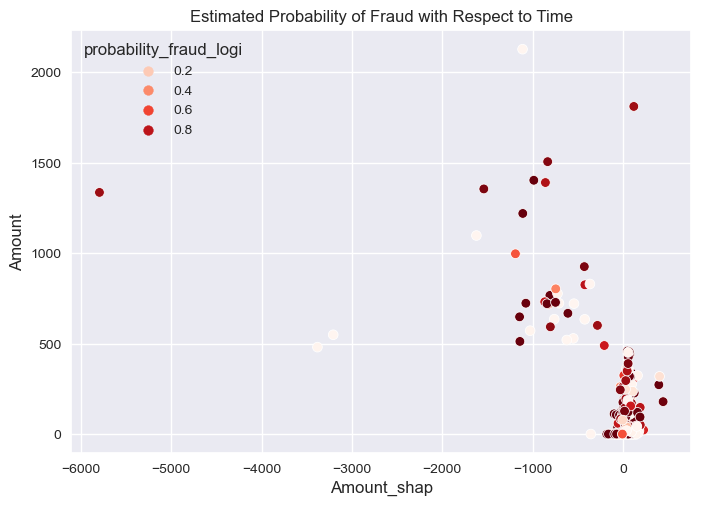

sns.scatterplot(overall_final,

y="Amount",

x="Amount_shap",

hue="probability_fraud_logi",

palette="Reds"

).set(title="Estimated Probability of Fraud with Respect to Time")

[Text(0.5, 1.0, 'Estimated Probability of Fraud with Respect to Time')]

Final Remarks, Discussion, and Practical Insights:

Observations

- Features V18,V8,V16,TIME and V7 has the most impact on the probability of fraud.

- The lower the value of V18 the lower the probability of fraud almost most fraud transactions predicted fraud influenced by lower value of V18.

- The higher the value of V8 the lower the probability of fraud, second-largest impact on the probability of fraud.

- The higher the value of V4 and V23 the higher the probability of fraud.

- The higher the amount of transaction the lower the probability of fraud but few example are predicted fraud impacted by amount feature.

- I sampled few examples that predicted as fraud and explained them locally with V12 and V17 pushed the prediction toward fraud with higher magnitude from the expected value of fraud, interestingly the opposite happened with 12 pushed the prediction toward non-fraud with higher magnitude from the expected value of non-fraud.

- Interestingly when visualizing the actual values of most impacted features that influences the probability of fraud we can see that:

- We can easily decide fraud transaction with high probability of fraud with V17 and V12 actual value being less than -5 with high shap values impact greater than 5K magnitude from the base value.

- The higher V4 the higher the impact of the model in predicting fraud.

- The higher value of V11 when its values is positive integer and greater or equal to 3 the higher the impact of the model in predicting fraud.

- Time of the transaction almost has no effect in distinguishing fraud transactions from non-fraud transactions.

Conclusion, discussion and Actionable Insights:

- The goal is to detect fraud from a series of transactions, the problem is very challenging as the data is highly imbalanced, tho I have came up with actionable insight from the data after investigating it and building multiple models and comparing them, the first actionable insight is of course is related to how certain we are in detecting fraud from population of transactions, we now logist regression model is efficient in its probability calibration so it outputs well calibrated probability output for this reason I have chosen this model to decide weather a transaction is a fraud or not based on the probability output, unsurprisingly the probability threshold is 0.1, so if the probability of a transaction being a fraud is greater or equal to 0.1 then we will consider it as a fraud.

- The second actionable insight is related to the features that are most important in detecting fraud, the lower the value of V18 the lower the probability of fraud almost most fraud transactions predicted fraud influenced by lower value of V18.

- thirdly interstage transaction that has higher the value of V8 which lower the probability of fraud.

- We can easily decide fraud transaction with high probability of fraud with V17 and V12 actual value being less than -5 with high shap values impact greater than 5K magnitude from the base value.

- The higher V4 the higher the impact of the model in predicting fraud.

- The higher value of V11 when its values is positive integer and greater or equal to 3 the higher the impact of the model in predicting fraud.

- Time of the transaction almost has no effect in distinguishing fraud transactions from non-fraud transactions.